The pronouncement that software is “eating the world” by Marc Andreessen has largely proven true. This can be seen in numerous ways: traditional consumer, healthcare and industrial companies are expanding their technology agendas and enhancing their software capabilities, sometimes by acquiring startups or recruiting senior leaders away from software and other technology companies. With few exceptions, all companies are becoming more digital and interconnected with larger business ecosystems. And software is at the center of it all.

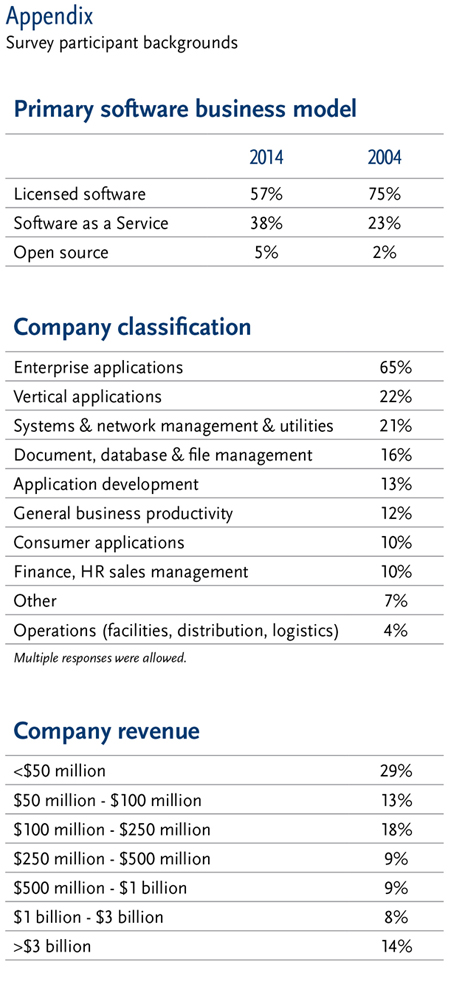

Against this backdrop, Spencer Stuart surveyed CEOs and other C-level executives of established software companies around the world about their most important strategic issues, the drivers of growth and their top leadership and talent priorities. Approximately 100 leaders responded. Among the findings:

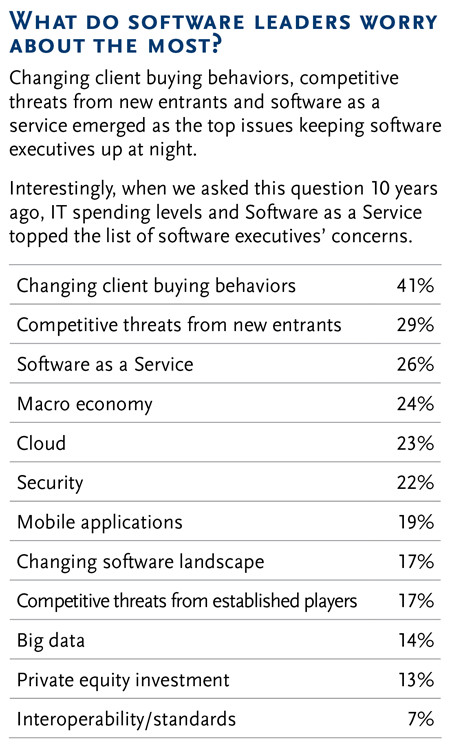

- Forty-one percent cited changing client buying behaviors as their company’s top priority or concern.

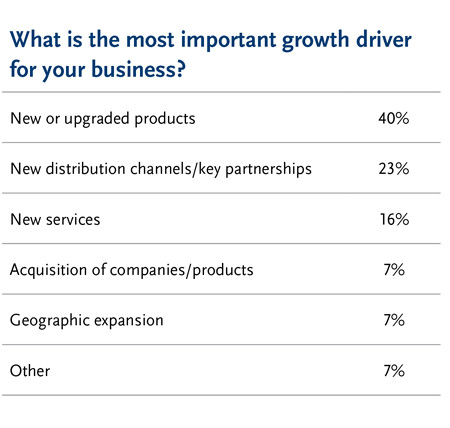

- The development of new and upgraded products is the most important growth driver for 40% of responding companies.

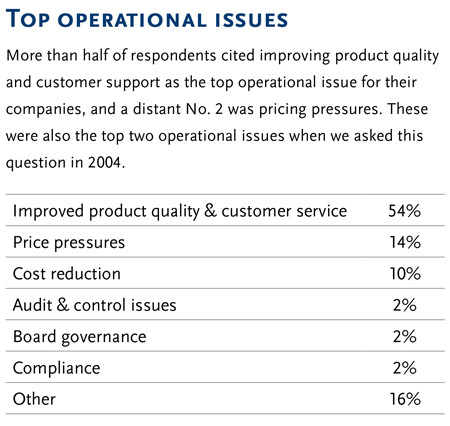

- Improving product quality and customer service is a top operational issue for 54% of companies.

- While sales leadership is the most in-demand functional area regardless of business model, we found differences in the talent priorities and needs of Software as a Service (SaaS) companies and licensed software providers.

To supplement the survey results, we spoke with Mark Hurd, CEO of Oracle, and Bill McDermott, CEO of SAP, to get their observations on industry trends and the survey findings. Also, where possible, we compared survey responses to those from a similar industry survey conducted in 2004.

Leaders’ top priorities and biggest concerns

Evolving customer behaviors was cited as the most common cause of sleepless nights by software executives responding to the survey. In particular, customers’ willingness to make do with older software for longer periods of time and their desire to get more of their software from the cloud are posing challenges for many software companies. Despite the growing importance of IT to business strategies in every industry, spending on IT has remained relatively flat.

As Hurd observed, "IT represents only a couple of trillion dollars of the $71 trillion gross world product, but that $2 trillion dollars is woven into the fabric of virtually all of the rest of the world’s GDP. Without us as an industry, a lot of things simply don’t get done in the worldwide economy.”

Since the financial crisis, businesses started to keep software for longer periods and, therefore, selling new licenses has become more difficult. While IT spending improved since the depths of the recession, it hasn’t returned to pre-crisis levels, software leaders observed. IT spending by companies has achieved a compounded annual growth rate of only 2% or 3% over the past decade, and much of companies’ spending is directed at maintaining their current systems, according to Hurd. Yet consumer spending on technology has exploded, as has the demand from business and functional leaders for applications to support data collection and analysis, and for the integration of systems and processes across the business.

“Instead of best-of-breed and line-of-business applications that appeal to particular buying centers, CEOs today recognize that IT no longer just supports the business; it is the business. And everybody has to have the competency of a CIO when they think about their business strategy and the enablement of it,” said McDermott.

As important as IT is to the success of any business today, many companies are operating with software created in a very different business environment. “The average age of an IT application in the Fortune 500 today is about 20 years old. So, those applications were built pre-mobile, pre-social, pre-search. These apps are just ‘pre-’ anything that we think of today,” said Hurd. “This is a real challenge for our customers, because our customers have very little IT spend chasing this incredibly sophisticated consumer. There’s an enormous amount of R&D coming from companies invested in consumer IT and consumer tools that is outstripping the ability of companies to keep up with them. As you look at that as the backdrop, it’s one of the reasons why you hear so much enthusiasm about the cloud and its ability to increase the speed of innovation.”

This tension between the demand for innovative applications and the constraints on IT spending is driving the SaaS marketplace, and emerging competitors are all SaaS players.

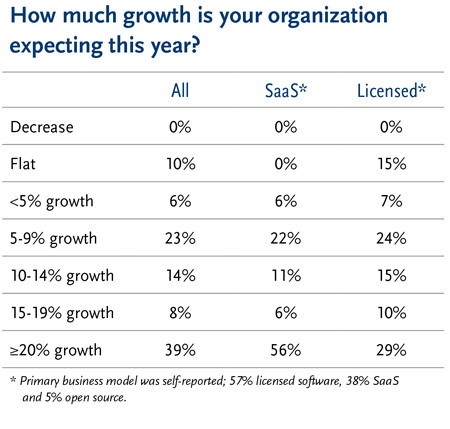

Despite the constraints on IT spending, 90% of survey respondents anticipated at least some revenue growth, with nearly 40% saying sales would grow by 20% or more. What’s driving growth? Areas such as artificial intelligence, non-relational databases and cloud analytics are experiencing rapid growth. Growth also is coming from geographic markets where IT penetration is lower than in Europe and North America.

The development of new or upgraded products is the most important driver of revenue growth, according to survey respondents, followed by new distribution channels or partnerships. These also were the top two growth drivers a decade ago.

Reflecting the industry’s movement to SaaS distribution models, SaaS players responding to the survey anticipated higher revenue growth than traditional licensed software providers; 56% of SaaS providers projected revenue growth of 20% or more — compared with 29% of traditional licensed software providers. All SaaS providers expected at least some revenue growth, while 15% of non-SaaS companies expected revenues to remain flat.

What does this mean for talent?

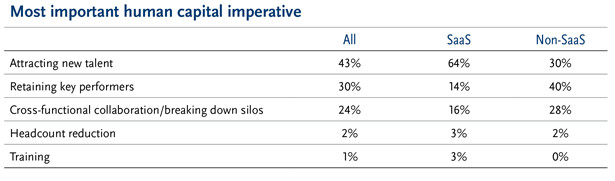

Forty-three percent of survey respondents said attracting new talent is the most pressing human capital imperative. Among leaders of SaaS companies, the percentage is even higher, at 64%. Traditional licensed software companies, meanwhile, are more likely to prioritize the retention of key performers (40% versus 14% of SaaS providers) and cross-functional collaboration (28% versus 16%).

Competition for top talent is fierce, but it was 10 years ago too, CEOs said. “Do we see more rivalry for talent today? My answer would be, ‘no.’ There is incredible rivalry for talent; there used to be and there still is,” said Hurd. “Finding talent always has been tough, and you’ve got to get the best people for what the company is trying to do. Everybody’s definition of the best people can be a little different, but it’s the best people for the execution of your strategy and your model.”

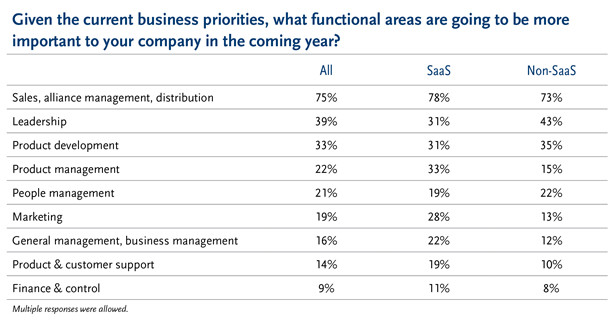

Sales leadership is overwhelmingly the most important — and most in demand — functional area for respondents in the coming year, according to the survey; 75% of respondents said sales, alliance management and distribution would be the most important functional areas for the business. This was true for both SaaS players and traditional licensed software companies. The relative importance of other functional areas, however, differed between SaaS and licensed software companies. Product management and marketing were rated as more important by SaaS respondents, while leadership and product development were more heavily weighted by licensed software providers.

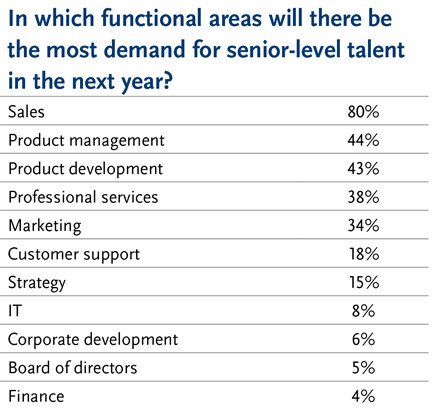

Competition is greatest for sales executives, senior leadership and product development executives, according to the survey. SaaS developers, security experts, digital marketers and product marketers also are in heavy demand, according to software leaders. Companies transitioning from a licensed software model to a SaaS model also will need to build pricing expertise.

Conclusion

Ten years after Spencer Stuart first surveyed software leaders about trends in the industry, some things haven’t changed. The development of new and upgraded products continues to be the most important growth driver, and improving product quality and customer service is the top operational issue for software companies.

Yet, some things have changed. Consumer spending on IT and tools has exploded, outstripping the ability of companies to keep up with them. This tension is driving the growth of cloud-based applications, as software companies and their customers look to increase the speed of innovation.

Competition for top talent will continue to be fierce, particularly for the most in-demand leadership roles: sales, product management and development, general management and marketing. Furthermore, as the industry increasingly moves to SaaS business models, leaders more than ever will need to develop a deep understanding of customer needs and a strong product mindset, as well as the ability to cut through huge amounts of data and zero in on a few key strategic priorities. Software companies that embrace these changes will be best positioned for success in the industry’s next decade.