Introduction

This study is the first detailed analysis to look at

the profiles of CFOs at South Africa’s top listed

companies by market capitalisation, the JSE Top 40.

Our research has produced fascinating data about

the profiles of CFOs and the routes they have taken to

reach the top of their function. We have paid particular

attention to CFOs’ background, functional experience,

diversity, education and professional qualifications.

We also take a look at the CEOs of JSE Top 40

companies with backgrounds in finance leadership.

We end our report by comparing South African CFOs

with their counterparts in Australia, the UK and the US.

KEY FINDINGS

Diversity

While our research reveals that their careers have taken a variety of trajectories, there is a conspicuous lack of diversity

among JSE 40 CFOs.

Ethnicity

Nine (22.5%) of the TOP 40 CFOs are from a broadbased black ethnicity group.

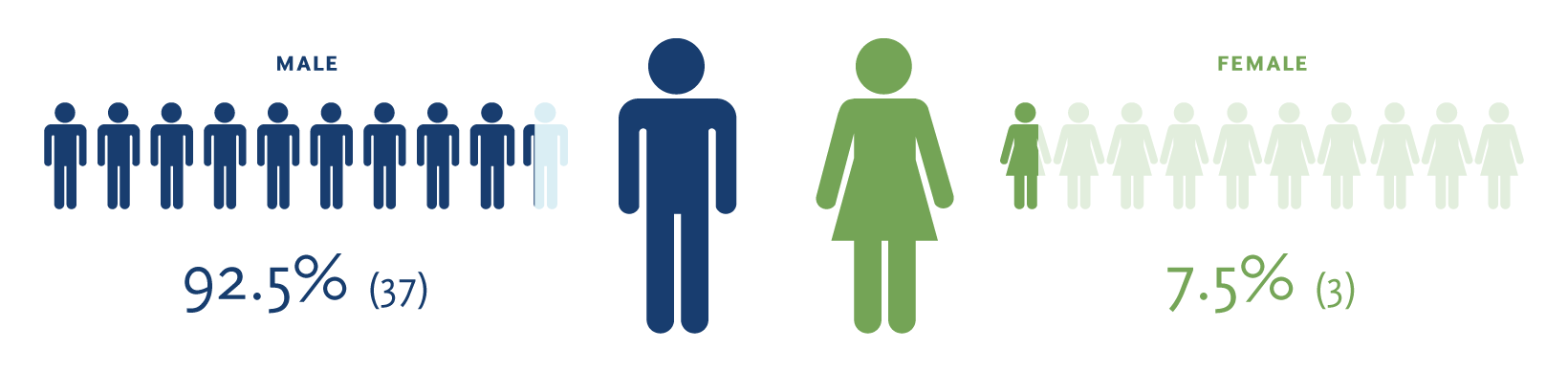

Gender

Only three out of 40 CFOs are women. While the percentage

of female CFOs is low in most markets, the situation

in South Africa is of particularly concern.

Nationality

Of those CFOs whose nationality we have been able to

confirm, only 15% are not South African nationals. These

five non-nationals come from Australia, Germany, Greece,

Netherlands and Zimbabwe.

Age

JSE 40 CFOs range from 36 to 61 years old, with an average

age of 49. Two-thirds of CFOs are between 46 and 55

years old.

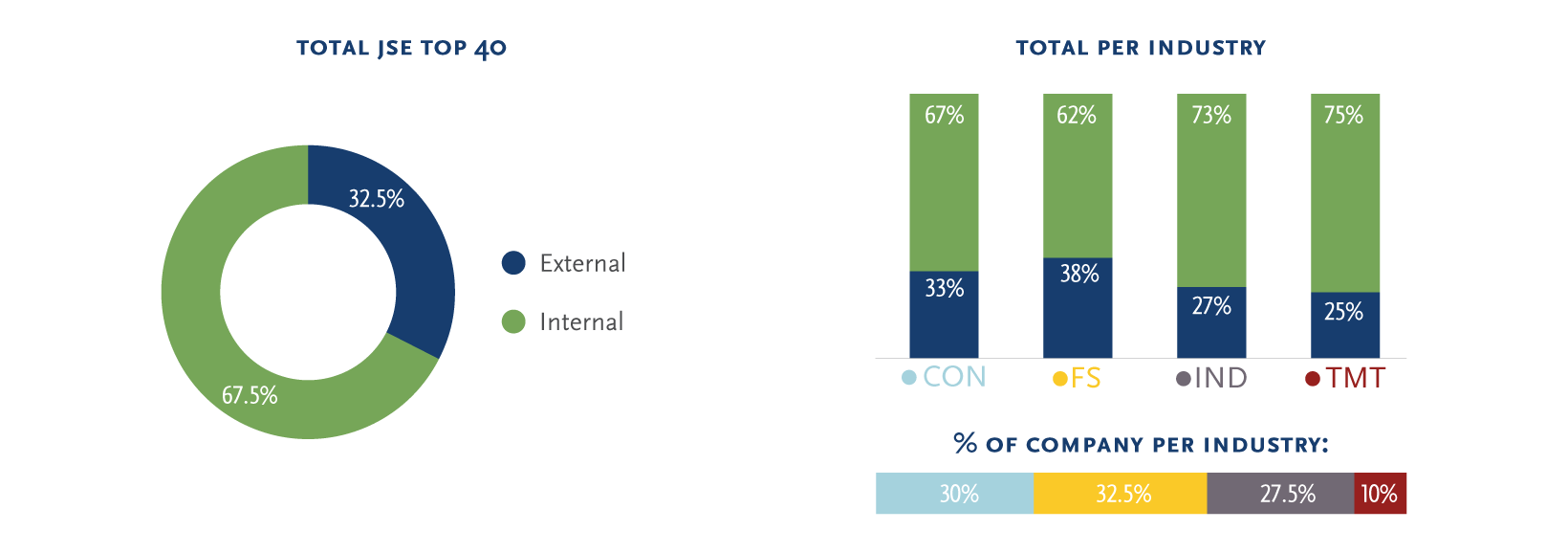

Internal vs. external appointments

Two-thirds of JSE Top 40 CFOs were appointed to their

roles from inside their companies. Leading South African

companies appear to have a strong enough pipeline to

enable a smooth succession in the leadership of the

finance function. They benefit from the continuity that

comes with appointing an internal candidate, as well as

the positive signals this sends to high-potential, future

leaders of the finance function.

Out of the seven CFOs appointed during 2017, four were

internal and three external candidates.

Development areas for companies to consider

With two-thirds of the current cohort of CFOs being internal appointees, many JSE Top 40 companies

appear to focus on finance talent management with an eye to CFO succession. However, we recommend

that all companies should be regularly reviewing their pipeline of high-potential finance professionals, steering

them towards the kind of roles that will position them to be credible candidates for CFO when the time

comes. We recommend that companies ask themselves the following questions:

- How do we encourage gender and ethnic diversity at all levels within our finance organisation?

- How do we expose high potentials to the challenges of high-impact communication and

stakeholder management?

- How do we make sure that our best finance professionals do not fall into the “specialisation trap”? How can we develop their skills and experience by offering them business or functional roles outside their comfort zone?

- How do we rotate high-potentials through roles in the corporate centre?

- How do we help finance professionals gain international exposure, especially experience living and

working abroad?

Tenure

The average tenure of CFOs is 4.1 years. Those in the

financial services sector have the longest average tenure

at 5.2 years (the CFOs at Capitec Bank Holdings and

Investec have both been in the role for at least 15 years).

The current average tenure of internally appointed CFOs

is 4.4 years, compared with 3.5 years for external hires.

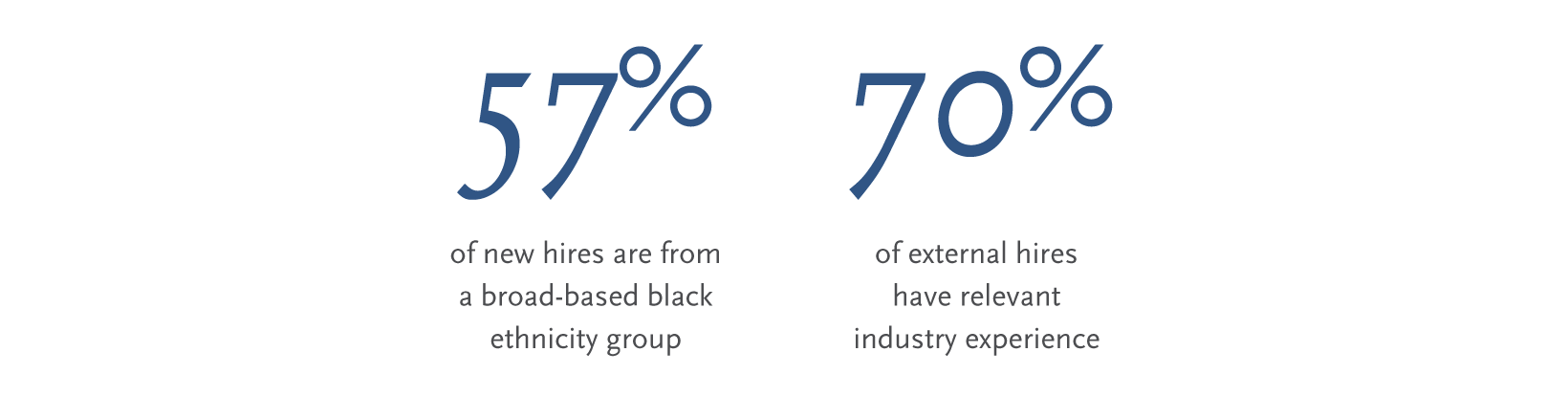

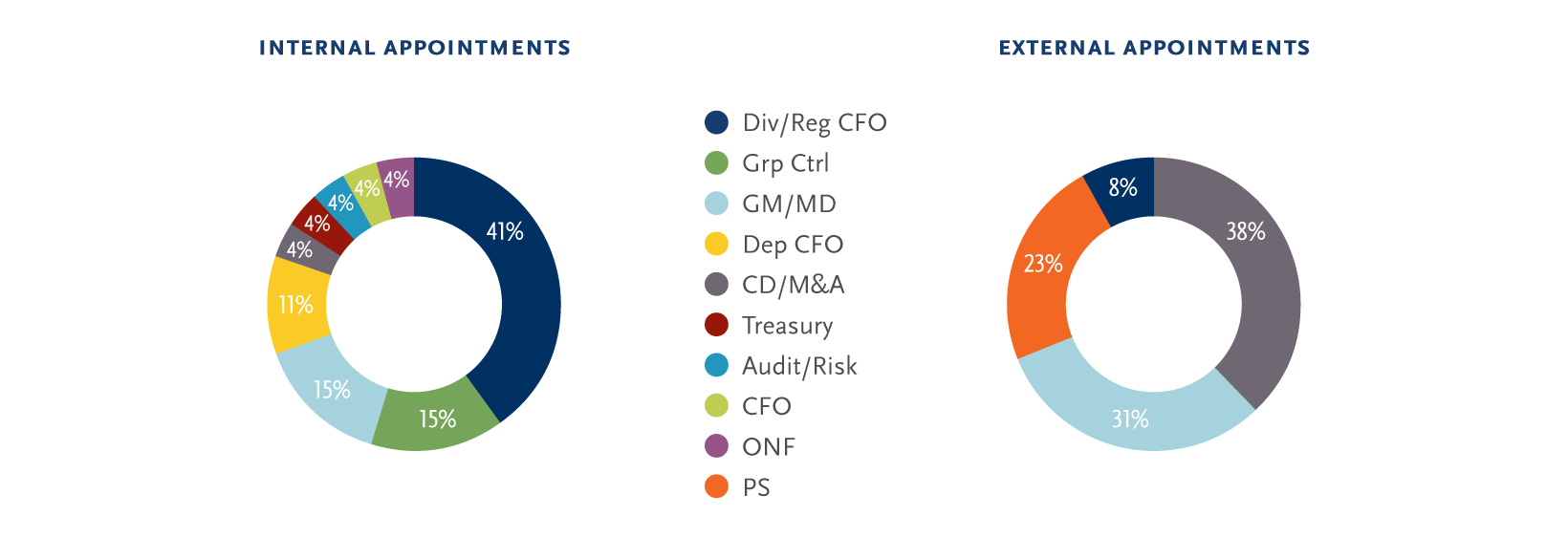

Previous role

Internal vs external

Of the nine CFOs with prior experience as a Group CFO,

six were external and three were internal appointments.

While external hires were mainly drawn from the ranks of

CFOs and general management, around one quarter of

these appointments came out of professional services/

audit firms.

JSE Top 40 CEOs with CFO experience

- 13 of the current JSE Top 40 CEOs previously held a Group CFO role. Nine of these had been CFO of the same

company they now lead, and six were appointed to CEO directly from the CFO role.

- Two CEOs had been the CFO of a non-listed company, whereas 11 had JSE CFO experience.

- CEOs who had previously been CFO of the same company had served as CFO for 5.7 years on average before

taking on the top job.

Finance function experience

Nine of the JSE Top 40 CFOs (22.5%) had prior experience

as a Group CFO. 45% were either a group CFO or a

divisional/regional CFO immediately prior to their

appointment. A further 20% were in a managing director

or other general management role.

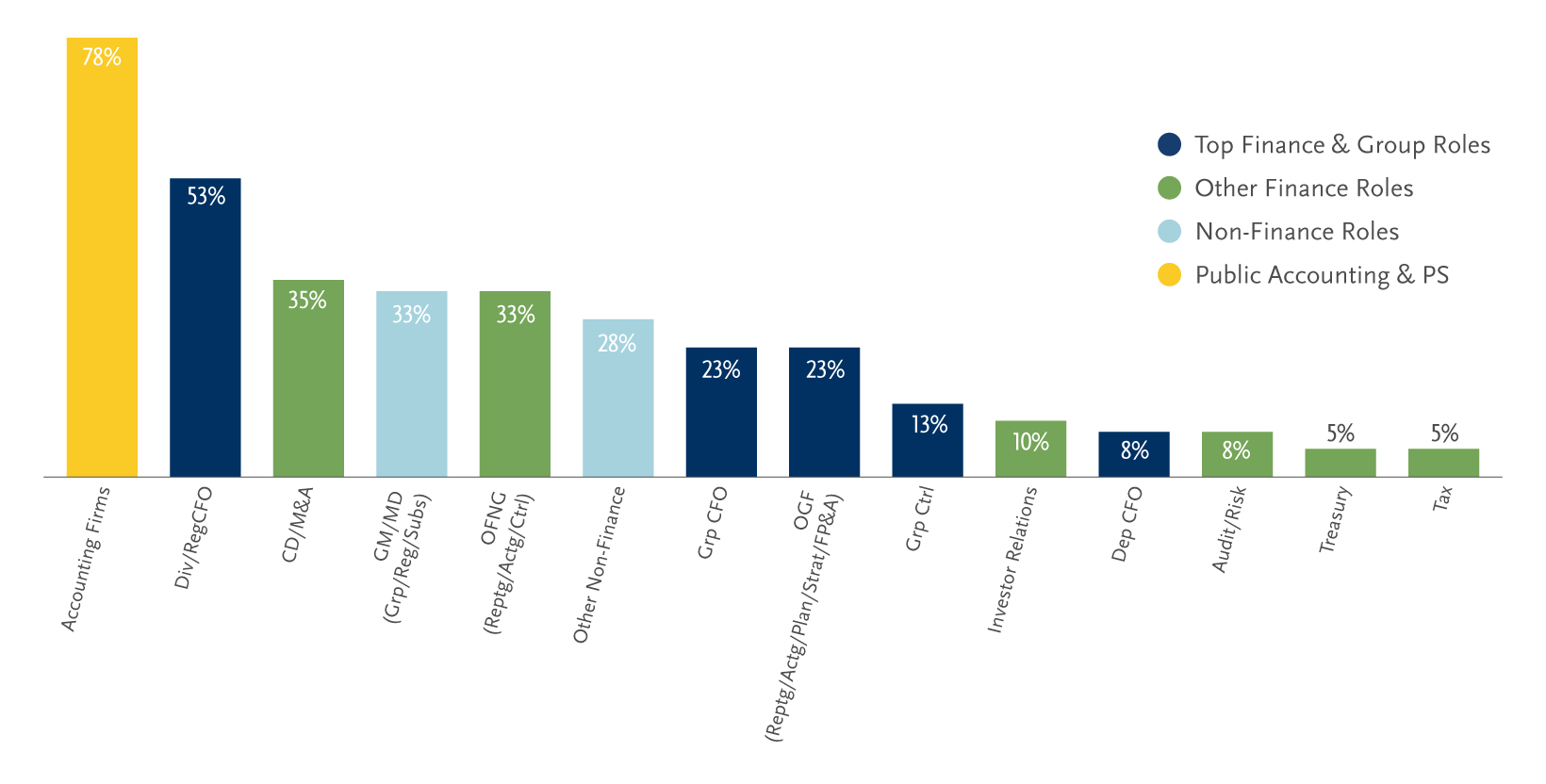

Career experience

The current cohort of JSE Top 40 CFOs have occupied a

wide range of roles during the course of their careers.

78% have worked in a professional services firm, although

this is explained by the fact when most of the current

CFOs were starting out, a three-year stint at an audit firm

was a prerequisite for becoming a chartered accountant

in South Africa or for a career in finance. It is interesting

to note that while most CFOs have spent the majority of

their careers in finance roles, 61% of CFOs have had at

least one non-financial role during their career.

International experience

Forty-five percent of CFOs have worked outside South

Africa at some point in their careers.

Education & qualifications

Ninety percent of CFOs have a Chartered Accountant

qualification. 22.5% of CFOs have a postgraduate degree

(Masters, MBA or PhD).

Board membership

All JSE Top 40 CFOs sit as executive directors on their own boards. Seven CFOs hold a non-executive directorship

on another listed company board; one CFO sits on two outside boards while another sits on four outside boards.

International Comparison

| Size of sample |

JSE Top 40 |

ASX 100 |

FTSE 100 |

Fortune 500 |

| Internal / external appointment |

67.5% / 32.5% |

49% / 51% |

48% / 52% |

62% / 38% |

| % of women |

7.50% |

11% |

11% |

13% |

| % of foreign citizen |

15% |

20% |

23% |

N/A |

| Average tenure |

4.1 |

5 |

4.5 |

5.6 |

| Average age |

49 |

51 |

52 |

52 |

Function Acronyms

| Grp CFO/CFO |

Group CFO |

| Dep CFO |

Deputy CFO |

|

Div/Reg CFO |

Divisional or Regional CFO |

| FP&A |

Financial Planning and Analysis |

| GM/MD |

General Manager/Managing Director (including COO and Group/Regional/Divisional CEO) |

|

CD/M&A |

Corporate Development/Mergers & Acquisitions |

|

Grp Ctrl |

Group Financial controller |

| IR |

Investor relations |

| ONF |

Other Non-Finance (Banks, Non Finance Roles, etc.) |

| OGF

|

Other Group Finance (Reporting, Accounting, Planning, Strategy, FP&A) |

| PS |

Professional Services/Accounting Firms |

|

OFNG Reptg/Actg/Ctrl

|

Other Finance Non-Group (Including Financial Reporting/Accounting/Control)

|

| Treasury |

Treasury |

| Tax

|

Tax

|

Industry Acronyms

| CON |

Consumer goods and services |

| FS |

Financial services |

|

IND |

Industrial |

|

TMT

|

Technology, media and telecommunications

|

METHODOLOGY

Our in-depth research draws on information in the public domain and on our knowledge of

the backgrounds of individual CFOs. This has enabled us to examine specific roles that

CFOs have undertaken inside and outside the finance function, identify patterns and

consider the range of experience that may be required of CFOs in the future. The data is

based on an analysis of the JSE Top 40 companies incorporated in South Africa as at

1 March, 2018. In the case of CFOs who were promoted from interim or acting CFO roles,

we consider their start date when they began their interim role.