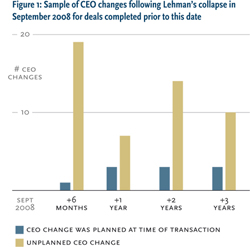

It is not surprising to learn that unplanned CEO changes in portfolio companies increased in frequency after the collapse of Lehman Brothers in September 2008 and during the subsequent global recession.

View larger image

Private equity investors have always believed that having the right CEO in a portfolio company is critically important to achieve the highest returns on their investment. In many cases, private equity firms reacted swiftly to a very different scenario than the one they prepared for at the time of their investment decision. Indeed, as soon as early 2010 a number of further CEO changes were made as companies that had completed their restructuring and stabilisation were in need of an injection of different leadership skills to develop and execute growth plans.

Private equity firms have become bolder in taking action and have reacted more promptly than many public company boards, demonstrating their “activist investor” capabilities rather well. Nonetheless, the decision to replace a CEO is never taken lightly. Sometimes, private equity investors reflect that they can be accomplices to the problem because they work so closely with the business. The firm’s reputation and ability to attract outstanding executives may also be at risk.

Yet our research into 155 changes of CEOs in European-based portfolio companies during the eight-year period from 2004 to 2011 highlights another concern for private equity firms (see Fig. 2).

View larger image

The overall picture is that in 50 per cent of cases, private equity firms actively planned to change the CEO. Of these, half were changed in the first six months of the deal and the large majority happened within 18 months. Firms identified the key components of their plan for the business at the time of the transaction or shortly after, assessed whether the incumbent CEO was the best person to shape it and carry it out, and put in place a new CEO if not. Planned changes occurring later in the life of the deal included replacement of the incumbent CEO (often the business founder) after an earn-out period, succession for planned retirements and, in several cases, preparation for an IPO.

Much more concerning is that 50 per cent of CEO changes were unplanned at the time of transaction. These included a few cases in which the investors saw warning signs but consciously deferred the decision on the CEO while they focused on other priorities: to close the deal, complete the financing and drive the first critical steps in the new business plan. Nonetheless, our analysis suggests that around 10 per cent of these unplanned changes were carried out within the first year of the deal and were mainly a speedy response to the wrong initial decision on the incumbent.

By contrast, nearly 90 per cent of the unplanned changes were made as late as two, three or even four years into the deal. What caused these changes? Had significant value been destroyed en route or had plans for creating value not been delivered?

We examined this part of the data in detail (see Fig. 3). Our research shows that half of the CEOs changed in years two to four were underperforming, and a further 10 per cent were unable to reach agreement on strategy or were unable to continue the relationship with the private equity firm. A further 10 per cent stepped down to take up a new post elsewhere, often because their equity was underwater and they were free to make the move. Better news is that 30 per cent of CEO changes were made swiftly in response to changing external circumstances. A number of covenant breaches and subsequent re-financings during the recession led to the requirement for new skills at the top to drive restructuring and, in many other cases, to refresh strategies for growth.

View larger image

The greatest concern must be the number of underperforming CEOs still in place two to four years after the deal. Can private equity firms do much more at the time of transaction to reduce the risk of finding themselves in this situation? We certainly believe so.

Does the picture change if we remove the impact of the collapse of Lehman Brothers and the subsequent global recession? Looking at data in the benign economic years of 2004 to 2007, the shape of the graph is actually very similar. What’s more, for acquisitions completed since September 2008 the signs are that the same pattern may be emerging again, although the data is skewed since at the time of writing we are only three years or less into the period of ownership. We shall certainly continue to monitor events closely. However, it seems the evidence is clear enough to take action now, starting with a review of management due diligence processes.

A number of private equity studies carried out over the last decade have confirmed the critical impact of the management team in the best performing deals (see Sources on p4). A common view is that the right CEO with the right 8 to 12 key team members is what makes the difference, and it is evident that private equity investors have continued to develop their strengths in dealing with management issues. As the probability of a CEO change during the life of the deal has increased, firms have refined their skills in managing CEO transition. Some are also investing time and resource in taking a much closer look at the management team at the outset and adopting a new approach to the assessment of the individuals’ capabilities and the team dynamic.

Now, as private equity firms are moving at pace into deal mode once more, new investments will bring in businesses that need to be managed in a commercial environment that is still volatile and fragile, yet where operational change will be the critical driver of value. Management performance is more crucial than ever. For private equity firms, this always starts with having the right CEO in place.

Research Methodology

We studied 155 cases of CEO changes in portfolio companies owned by private equity firms across Europe from 2004 to 2011. Our data covers a large percentage of all portfolio company CEO changes in businesses based in Europe with revenues above €150m. The sample covers a broad range of industry sectors and includes businesses owned by a wide number of mid-market and mega funds. Spencer Stuart holds a leading share of portfolio company CEO search mandates and in the cases managed by other executive search firms, we have had access to relevant individuals involved. This information is confidential and no individual cases will be disclosed.

Sources and Further Reading

- Ten lessons for all companies from private equity, Spencer Stuart, 2008

- Best practice in managing investments, McKinsey & Co, 2006

- How do private equity investors create value?, Ernst & Young, 2006

- Survey of 330 European investors, SJ Berwin, 2004

- CEO Succession: making the right choices: A study of CEO transitions across four prominent European markets, Spencer Stuart, 2011

Spencer Stuart's Executive Assessment for Private Equity

Spencer Stuart’s European Private Equity Practice first researched the reasons for CEO changes in portfolio companies in 2007, during the economically benign years prior to the global recession. The surprising results showed a similar picture to what we are reporting here after a full eight-year analysis — namely, that a large number of CEO changes were made two to four years after the transaction date which had not been planned for at the time of the deal and were, in the main, due to underperformance.

Our hypothesis was that significant value may have been lost in that period. We talked to private equity clients to ask whether they were doing everything possible at the deal stage to ensure they had the right management team in place, the right support structures and, importantly, actions to develop top individuals in order to ensure they would be successful in the new ownership environment and with the new business plan.

We introduced our Executive Assessment experts who worked closely with a number of firms to review their management due diligence processes; as a result, we have evolved methodologies specifically for private equity, further tailoring them for each individual firm’s approach. For example, we are able to assess whether individuals have the capability to work constructively with private equity investors and whether they can continue to do this if the business environment changes during the lifetime of the investment.

Recognising that it is often not possible to assess people before a deal has been completed, we also shaped the assessment process so that it could be institutionalised as part of the post transaction 100 day plan. Are CEOs daunted by this? Actually it is rarely an issue. They have quickly seen the benefit of setting out with clear support in an exciting role, with a detailed picture of their team and transparency about what they need around them in order to deliver.

With a few years’ evidence now to draw upon, we have good news to share regarding the impact of this process for private equity investors. Our clients, who have more than just anecdotal evidence, are telling us that their best performing deals have turned out to be those in which the Executive Assessment showed the management team to be the strongest.