Executive Summary

-

Private equity firms have been early

and effective adopters of cutting-edge

assessment methodologies

-

CEO changes are better planned and

happening sooner in the deal cycle

-

However, there is no reduction in the

number of deals that require the CEO

to be replaced more than once

-

Private equity firms have a stronger

track record in hiring best-athlete CEOs

regardless of their background (e.g. nonnationals or executives from outside the

sector) compared with listed companies

-

More can be done to widen the leadership

talent pool — there are very few women CEOs and internal CEO succession

contenders are often overlooked

Private equity firms have greatly improved their ability over the past five years to hire the right CEO in a portfolio company and support them in their role — but there are still opportunities for the sector to do better and widen the available talent pool.

The past decade, and in particular the last five years, has been widely recognised as a golden era for private equity. As global markets recovered from the shock of the last financial crisis, private equity firms did not simply sit back and reap the rewards of the improving market conditions. Quite the opposite. Learning the lessons from the crisis, they placed greater emphasis on being more hands on with portfolio companies. Many firms deployed a much wider range of capabilities to drive value, for example building operating partner teams and adding more specialised functional expertise (e.g. in finance, IT, supply chain, HR and digital) to assist management teams in transforming performance.

A critical component of this approach has been to apply more rigorous assessment to the management team and especially the CEO. Private equity firms have been early, enthusiastic adopters and expert users of cutting-edge assessment methodologies in recent years. Many firms have institutionalised the assessment of management teams during the first 100 days following a deal, giving them deep insights into their new investment. This allows them to plan and shape the right support structure around the management team and apply the full range of the investor’s new functional capabilities to position the team for success.

A challenge unique to private equity investors is ascertaining whether a CEO and management team can work openly and collaboratively with their new owners. Can they adapt to that private equity firm’s particular approach and make full use of the support provided to them? Or will they maintain a distance to their owners and fail to maximise the value of the expertise available? If not, the incumbent CEO will underperform, regardless of their capabilities.

In our 2011 study we looked at the timing of, and reasons for, CEO changes in private equity portfolio companies between 2004 and 2011. We concluded that a lot of value was being lost due to underperformance, with private equity investors forced into a large number of unplanned CEO changes. More than half of these occurred in the later years of the deal, i.e. from the third year onwards. Some research suggests that having the wrong CEO in situ after the first year is a major reason why deals underperform and typically leads to longer hold times and lower returns.1 With all the new assessment capabilities and functional expertise at their disposal, private equity firms should be more successful than they have been at identifying the right CEO in the first year and supporting him or her to be a success.

Have private equity firms learned lessons and maximised their opportunities during this golden era?

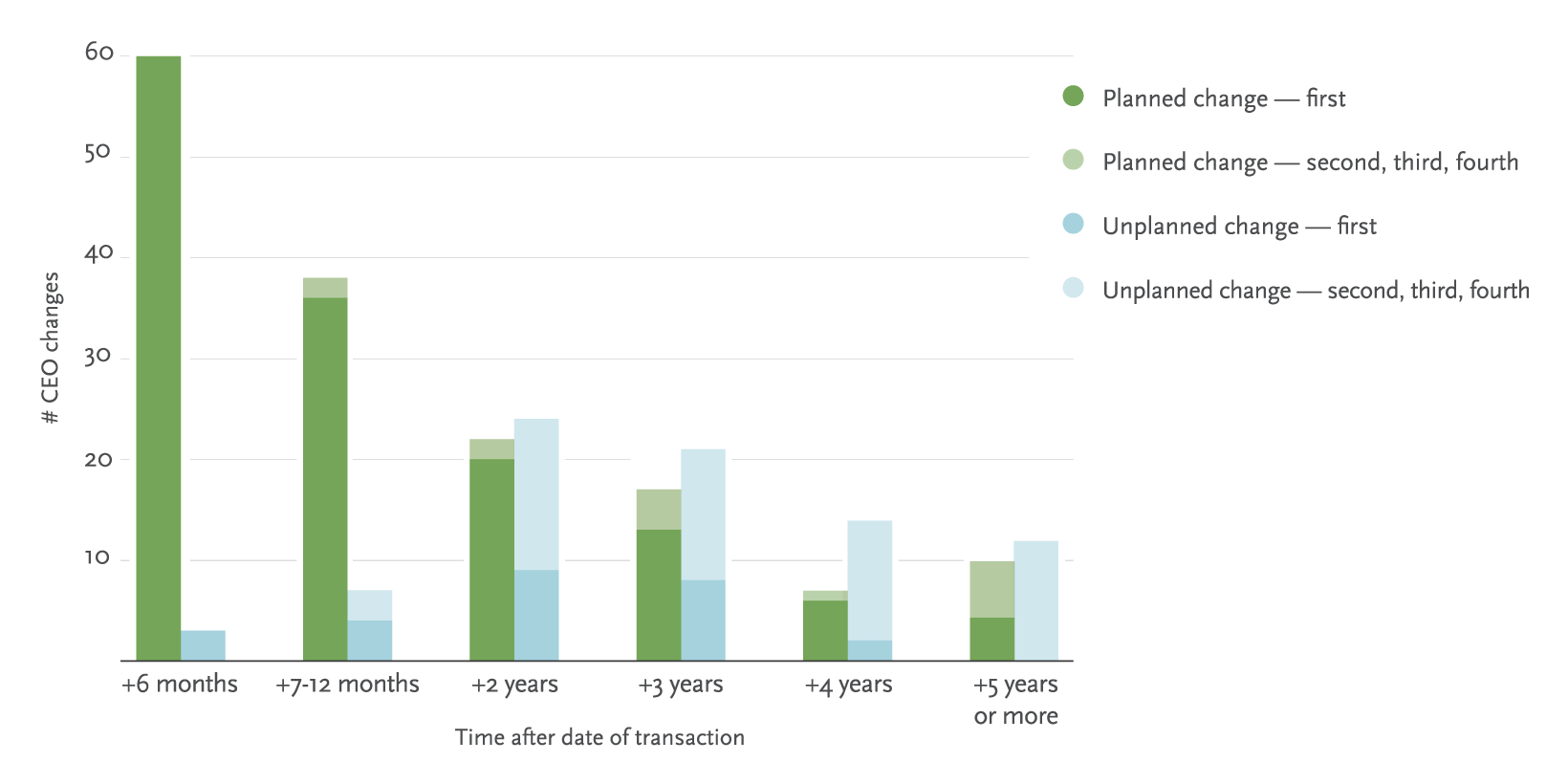

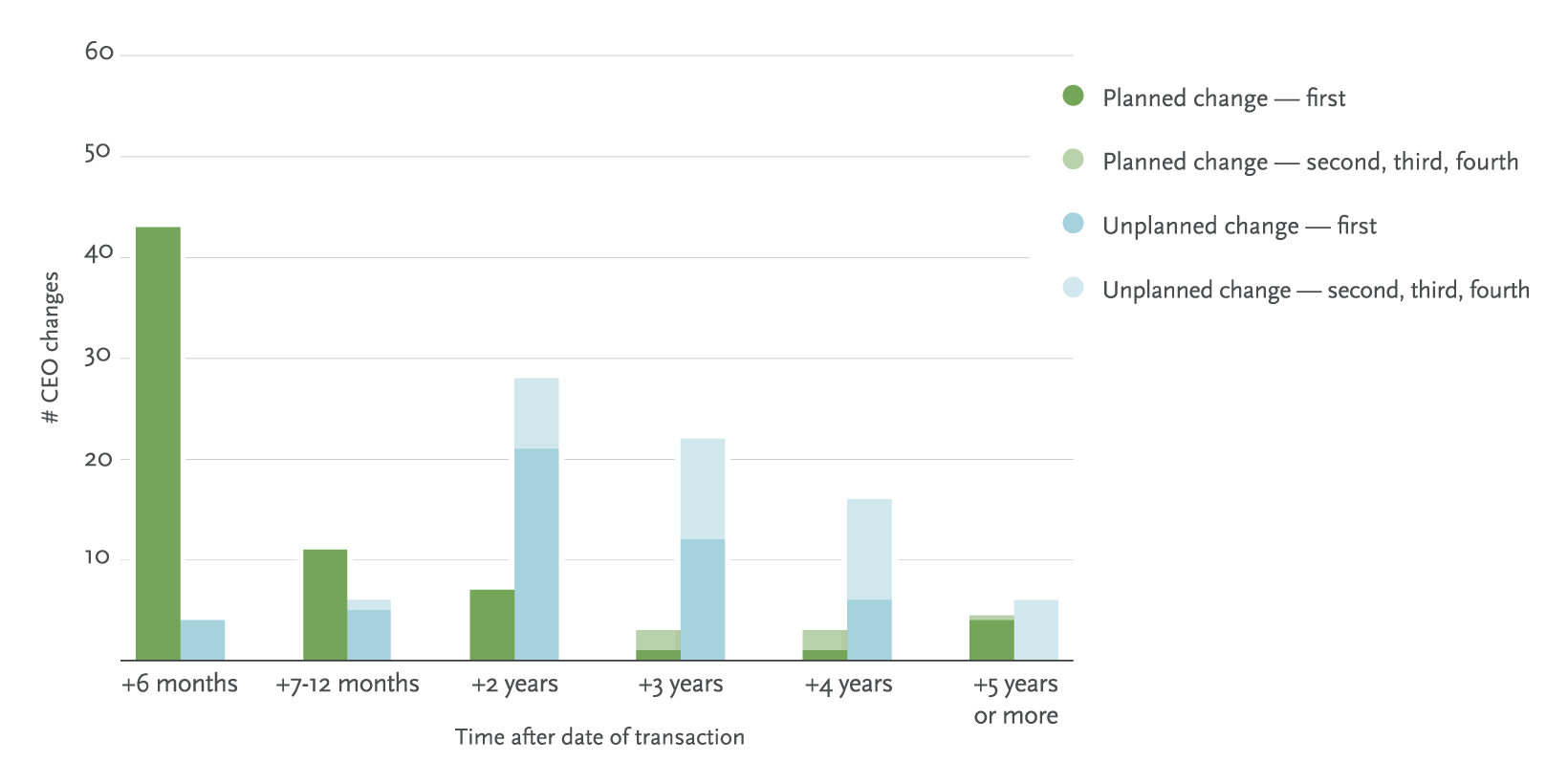

Our research suggests that the answer is broadly yes, though there are still opportunities for further improvement. For this comprehensive study we have reviewed 236 changes of CEO following transactions completed between January 2009 and March 2018. The good news is that we have seen a clear shift in private equity firms’ ability to control the timing of CEO transitions, with only 35% of CEO changes unplanned at the time of the transaction. It is equally encouraging that nearly half of all changes occurred within the first year, a growing trend since 2013. This is a strong indicator of rigorous assessment having a clear effect on the speed and quality of decision-making (see Figures 1a and 1b, comparing our new and original studies respectively).

One noticeable trend during the past decade has been the lengthening of average hold periods to around five years. Private equity firms are now commonly facing the conundrum of CEOs completing four years in their role without seeing a successful exit. This has created a need for planned CEO successions in the later years of some deals (i.e. from the third year onwards). Already 12% of the CEO changes we analysed involved carefully planned succession processes from the third year onwards, despite this being a recent development. We anticipate that as firms hold on to assets for longer periods they will need to strengthen their succession planning later in the deal cycle and consider a more diverse pool of potential leaders.

Research methodology

We studied 236 cases of CEO transitions in portfolio companies acquired by private equity firms across Europe from January 2009 to March 2018. Our data covers a large percentage of all portfolio company CEO transitions in businesses based in Europe with revenues above €150m. The sample covers a broad range of industry sectors and includes businesses owned by a wide number of mid-market and mega funds. Spencer Stuart holds a leading share of portfolio company CEO mandates and in the cases where replacement searches were handled by other firms, we have had access to relevant individuals involved. This information is confidential and no individual cases will be disclosed.

Timing and number of CEO changes made after the deal completion date

Figure 1A: New study (changes made between Jan 2009 and Sept 2018)

Figure 1B: Original study (changes made between Jan 2004 and July 2011)

Another trend that should give private equity investors pause for thought is that around 30% of all the CEOs hired were later replaced in unplanned changes; on this measure there has been no improvement since our original study.

This tendency for replacing the CEO more than once during the lifetime of a deal reflects firms’ greater willingness to course correct. Although the second CEO change now tends to happen earlier, multiple changes of CEO can nonetheless be disruptive. Acting decisively to remove underperforming CEOs is important, but we question why it is so frequently required.

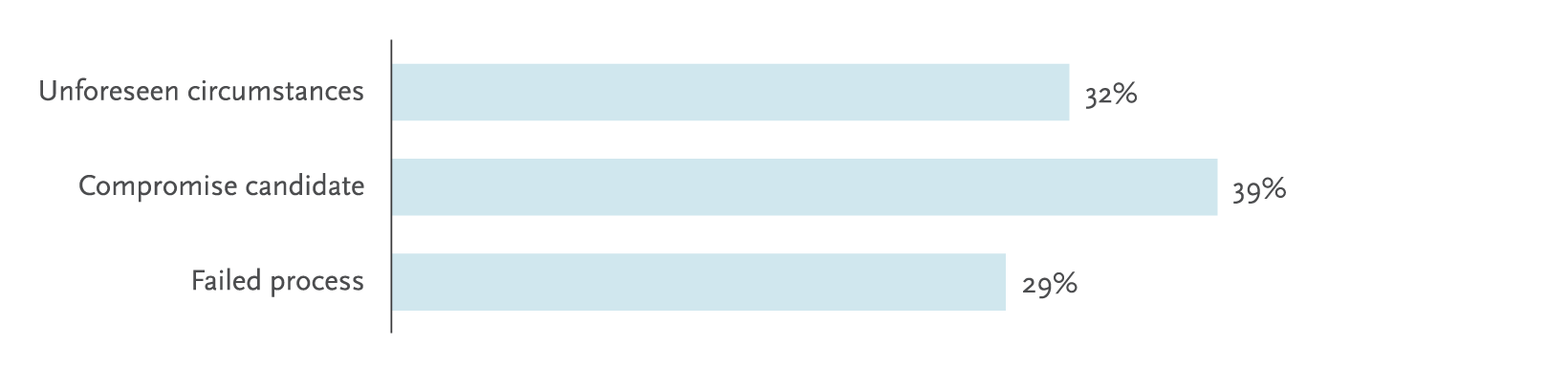

We took a closer look at this part of the data to understand what lay behind these seemingly failed appointments. The good news is that the picture that emerged reflects more positively on private equity firms. We found there to be three distinct scenarios (see Figure 2):

-

The change was instigated by events which the private equity firm could not have foreseen at the time of the investment

-

The investor knew it might not have the right CEO for the duration of the transaction, but under time pressure to drive change appointed a CEO who could bridge the transition of ownership and address the key initial challenges

-

A failure in the recruitment process or the ability to support the CEO following their appointment.

Figure 2: Analysis of why the first unplanned CEO change failed

The first and second scenarios should not unduly concern private equity firms. The first is out of their control and the second reflects firms’ deliberate pragmatism and willingness to compromise and accept the ‘best-currently-available’ option, before finding a different solution at an appropriate later stage. Could the investor have done more to find a better solution first time? In certain instances, perhaps, but there was a conscious decision to settle on an imperfect solution while more urgent issues were addressed.

It is the third scenario that private equity firms should wish to focus their attention on, as this is where value is still being lost. These were often first-time CEOs and were typically replaced by the perceived ‘safe option’ of a proven CEO. Was every possible lens applied in the first appointment to identifying the right individual with the experience, capabilities and style to deliver the strategy? Did the individual’s style fit with the existing or target culture of the organisation? (See box-out: Culture and style matter.) Were the right support structures put in place to help them collaborate effectively with the private equity investor and the rest of the management team?

A first-time CEO may tick all the boxes required, but nonetheless struggle to work well with this type of investor, compared with a proven private equity CEO who already knows how to communicate the strategy and performance in the manner they expect. Could more have been done to help the first-time CEO collaborate and move up the transition curve quicker? With more rigorous assessment and better support structures generally now being adopted across private equity, we should expect to see some improvements in this area in the coming years.

Who are the CEOs that private equity firms are hiring?

As in listed companies, the CEOs hired to run private equity portfolio companies are overwhelmingly men — only 5% of CEOs appointed in our study were women, with no change in gender diversity in recent years. There is a clear opportunity to broaden the CEO candidate pool and many firms (under increasing pressure from limited partners) are becoming highly conscious of the need to focus on gender diversity in their portfolio companies. Training their investment and operating partner teams in how to manage unconscious bias in the recruitment process may be an important step in the right direction.

Our research shows that, in line with European listed companies, three-quarters of all the CEOs hired between January 2009 and March 2018 come from the same sector.

Despite these similarities, there are some marked differences. Over the past five years listed companies consistently promoted an insider (internal candidate or a board member) in more than 60% of cases, whereas private equity firms generally appointed outsiders. Only 19% of the CEOs in our study were insiders; over the past five years the trend has moved even further away from internal succession.

This lack of internal successors reflects a clear preference among private equity firms for proven CEOs. Our study shows that 38% of the private equity CEOs hired since 2013 were proven CEOs, compared with 30% of listed company CEOs. Private equity is far more likely to overlook internal step-up talent in favour of proven CEO talent elsewhere. Yet, a number of private equity firms tell us that their internally promoted CEOs have been some of their best performers.

One-third of the proven CEOs hired had no direct sector experience, a trend which has continued to grow in recent years. This reflects the new-found trust private equity firms have in their use of assessment and their greater willingness to take risks by hiring proven CEOs from outside the sector, trusting in their versatile leadership skills.

These best-athlete CEOs do however have one characteristic in common — two-thirds had previously worked in a private equity-backed business or as an operating partner. This suggests firms are at the same time playing it safe, opting for what has been known to work in the past. This may also reflect the fact that as the private equity sector grows, the number of candidates with a proven private equity track record continues to expand and these individuals form an obvious pool to target.

Unlike listed companies in most European jurisdictions, with perhaps the exception of the FTSE 100, one-third of the CEOs hired were non-nationals, reflecting private equity’s more international approach to finding talent.

Culture and style matter

In addition to unlocking motivations and drives through deep assessments, Spencer Stuart has developed a unique framework for assessing both organizational culture and an individual’s style profile. An organization’s culture can support or undermine its business strategy and this is especially critical in a new private equity ownership phase with intense pressure to drive change at speed.

Further, understanding individuals’ styles and any potential tensions will allow private equity firms to build deeper collaborative relationships and work more effectively with their management teams. This should lead to fewer failed hires and fewer unplanned changes later in the deal cycle.

For more information on Spencer Stuart’s approach, read "The Leader’s Guide to Corporate Culture", one of HBR’s 10 Must Reads of 2019.

What can the private equity and listed sectors learn from each other?

Listed companies could learn from private equity firms’ greater willingness to trust high-calibre individuals to provide greater leadership horsepower than ‘safer’ choices from within the sector. As listed companies refine their CEO succession processes, there is an opportunity to more rigorously test the external market beyond their own and adjacent sectors and their own nationals, thereby considering a wider range of proven international CEO talent as part of their benchmarking. There have been several examples in recent years of highly successful CEOs who have delivered superb returns for their private equity owners in completely different sectors.

So what lessons can private equity firms learn in return? The private equity industry has come a long way over the seven years since our initial study, greatly improving its assessment and hiring processes. Nonetheless there is untapped potential in the market and listed companies tend to be better at developing and promoting internal leadership talent. Part of a private equity firm’s mandate is to deliver value the previous management had not, so it is fair to assume they will hire more outsiders. However, it seems improbable that so few internal candidates are capable of stepping up and leading the new strategy.

Private equity firms might also do more to hire best athletes who are not proven CEOs. Having recognised the relative value of outstanding leadership versus sector knowledge, firms could also learn to trust that step-up candidates can bring similar leadership capabilities.

Taking these steps would play a part in improving gender diversity too, since the preference for proven private equity CEOs will not provide a sufficient pool of candidates to realise that goal.

Having changed the CEO, private equity investors may wish to continue to refine how they cooperate with management to ensure their success. In addition to providing them with continuous support and advice, private equity firms can do more to understand the motivations, drives and leadership styles of their management teams.

*********

Private equity firms have made great strides since the financial crisis during this recent golden era and created a much stronger platform to build on ahead of the next cycle. Spencer Stuart will continue to help industry players refine their leadership capabilities, draw on the widest pool of potential talent and support their CEOs to be successful in realising the full potential of their portfolio companies.

1“Annual private equity survey: replacing a portfolio company CEO comes at a high cost”, Alix Partners, May 2017