Different CFOs have taken different paths to reach the top, so there is no one “right way” to get there. But if we look at the data, we see there are patterns in the backgrounds of today’s CFOs. To find these trends, Spencer Stuart has analyzed the backgrounds and demographics of the CFOs of the largest and most influential companies in the United States and Europe over the past 10 years.

This is the first time we have studied the CFO route for executives in Latin America, and we now have a deeper understanding of what has prepared Latin American CFOs for the leadership positions they occupy. This report examines CFOs of top companies in Colombia — specifically, the 20 companies that make up the COLCAP Index — and compares this data with that from other countries (in this study, “Latin America” refers to Argentina, Brazil, Colombia, Mexico and Perú).* We pay particular attention to CFOs’ functional experience, their academic background and the difference in the profiles between internal promotions and external hires.

Executive summary

-

Gender: 85% men/15% women

-

Average age: 49 years old

-

Country of origin: 95% of CFOs in Colombia are local

-

Average tenure: 4,5 years

-

Internal vs. external: 50% were promoted from within

-

Previous experience: 65% of current CFOs had previously worked as CFO

Diversity: Colombia ranks 2nd, but there is room for improvement

Overall, gender diversity among CFOs in Latin America is low; nonetheless, Colombia has a relatively high percentage of female representation (15%) compared to Latin America (8%). Surprisingly, the female presence in Latin America is higher than in Europe (6%), but still remains lower than the Fortune 500, where 13% of the CFOs are women.

While Latin American gender diversity is low, this trend should change over the next several years as our clients are increasingly focusing on female talent when hiring.

CFOs in Colombia are older than in Latin America

The average age for CFOs in Colombia is 49, just above the Latin America average age of 48. In Colombia, CFOs were typically about 44 when appointed to their current position, two years older than the Latin American average. By comparison, European companies tend to hire CFOs in their mid-40s and Fortune 500 companies hire executives who average 50 years old.

CFOs have had their current position for less than 5 years

CFOs in Colombia have been in their current role for an average of 4,5 years, and there is no significant difference in tenure between internally appointed CFOs and their externally hired counterparts. Compared to other countries and regions, Colombia’s CFOs have the shortest duration in their current position: The average duration for Latin America CFOs is 6,3 years, followed by the U.S. at 5,7 years and the UK with 4,9 years.

Nearly all CFOs in Colombia are from that country

Ninety-five percent of all CFOs are Colombian-born, which is a higher percentage of homegrown talent than among Latin American (86%) and European CFOs (almost 90%). The likely explanation is that the majority of the companies we analyzed are not subsidiaries of foreign multinational companies, which tend to transfer their financial directors among their subsidiaries.

Most CFOs had previous experience in the position

Overall, 65% of all COLCAP CFOs had previous experience in the role, and there is no significant difference between internal and external hires in this trend. By comparison, 31% of Fortune 500 CFOs had previous experience in the role. Of those Colombian CFOs who were hired externally, 74% had previous experience as CFO (which aligns with what we found in Latin America). In Europe, almost half of all executives already had previous experience in the position.

In Colombia, 70% of all external hires come from a different industry than their current employer, similar to Latin America. However, this is far from the backgrounds of CFOs in Fortune 500 companies, as only 14% come from a different industry. Surprisingly, more than half of the CFOs analyzed in Colombia come from the financial sector, which is unique to companies within the COLCAP index.

Half of Colombian CFOs are external hires

When appointing a new CFO, COLCAP companies are equally comfortable hiring an external candidate or promoting an internal executive: 50% of all CFOs were internally appointed. This trend is in line with Europe (54%), but differs from what we’ve observed in Fortune 500 and Latin American companies, where 69% and 63% of CFOs were internal appointments, respectively.

Generally, internal appointments tend to take place in companies with large finance departments and therefore have more possibilities for development. This surplus of opportunities leads to more credible internal candidates for the top finance role.

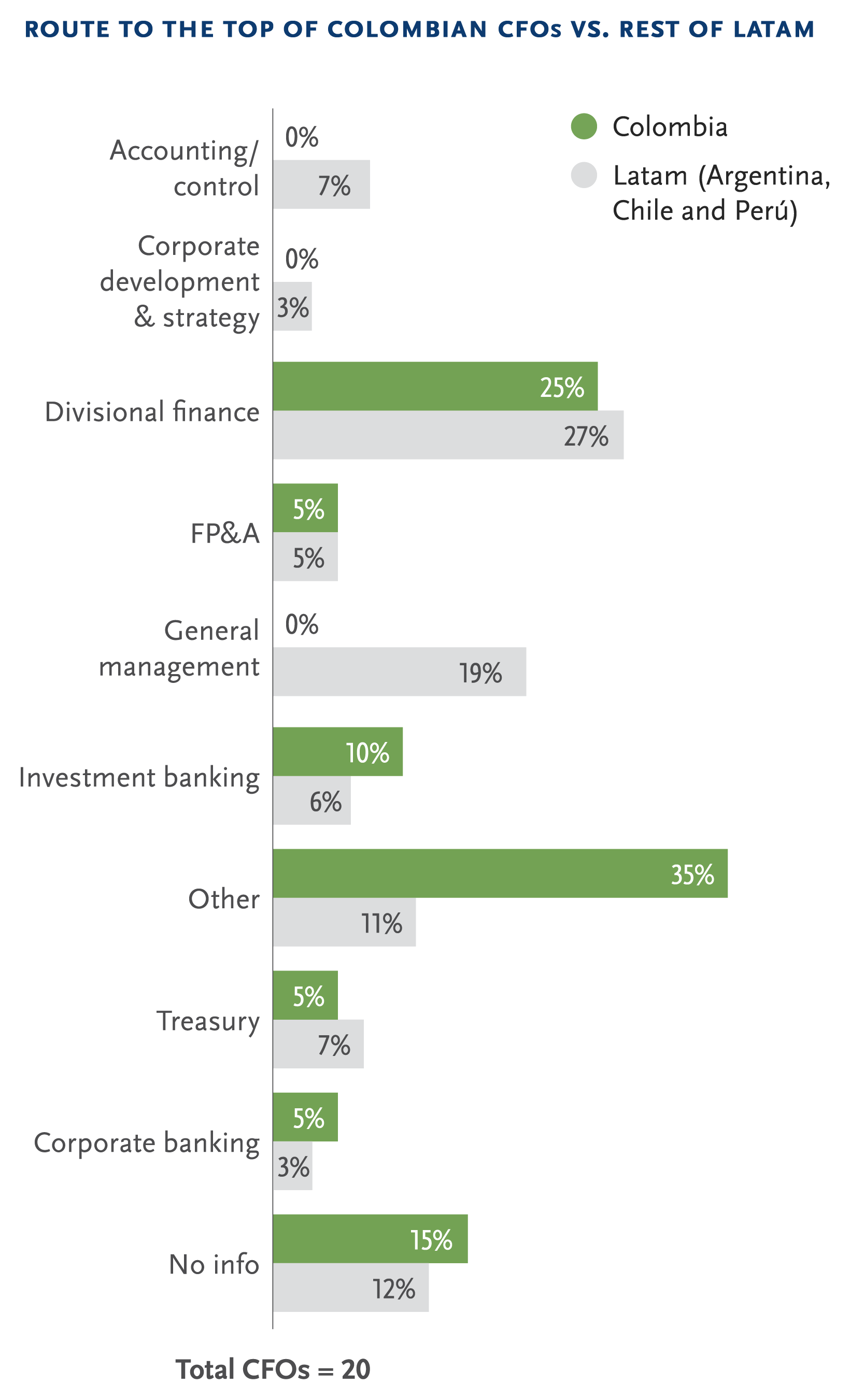

Route to the top

The route to the top represents the function or discipline in which the CFOs spent the most time in their careers before assuming their current role.

The most common route to the CFO role in Colombia is divisional finance (25%). Nevertheless, the majority of CFOs (35%) come from other areas, such as consulting, project management and investor relations. The most frequent route for CFOs in Latin America is the financial division with 27% and the second-most popular path is general management (19%).

For CFOs in the United States and Europe, the most common route to the position is via the financial division.

Most CFOs have a post-graduate degree

All CFOs in Colombia have a bachelor’s degree. Broken down by major, 35% of CFOs in Colombia majored in business administration and 30% studied engineering (civil, systems or industrial). These trends align with what we find in Latin America — except for Argentina and Mexico, where there is a higher concentration of executives with CPA and accounting backgrounds.

Thirty percent of CFOs in Colombia earned their undergraduate degree at Universidad de los Andes and 20% graduated from Universidad EAFIT.

Ninety percent of the CFOs in COLCAP have a post-graduate degree, and 70% of that group studied abroad (43% studied in Europe and the rest went to school in the United States). Those who earned their post-graduate degree in Colombia graduated from one of the following universities: INALDE, Universidad Pontificia Bolivariana, Universidad de los Andes, Pontificia Universidad Javeriana de Cali and Universidad EAFIT.

| Academic background |

Argentina |

Brasil |

Chile |

Colombia |

México |

Perú |

Latam |

| Accounting (CPA) |

45%

|

12%

|

8%

|

10%

|

29%

|

12%

|

19%

|

| Business administration |

35%

|

34%

|

44%

|

35%

|

17%

|

47%

|

35%

|

| Engineering (civil, industrial, systems, etc) |

5%

|

23%

|

33%

|

30%

|

27%

|

18%

|

23%

|

| Economics |

10%

|

20%

|

8%

|

15%

|

16%

|

23%

|

15%

|

| Other |

5%

|

7%

|

4%

|

10%

|

4%

|

0%

|

5%

|

| No information |

0%

|

5%

|

3%

|

0%

|

6%

|

0%

|

2%

|

Methodology

For this report, Spencer Stuart conducted research during the first quarter of 2018 into the background and career trajectory of 592 CFOs who serve the top companies in six leading indexes:

-

Argentina: Merval (25 companies)

-

Brazil: Bolsa, Mais, Mais-Nivel 2, Nivel 1, Nivel 2 and Novo Mercado (373 companies)

-

Chile: IPSA (40 companies)

-

Colombia: Colcap (20 companies)

-

México: México IPC (116 companies)

-

Perú: Perú Select (17 companies)

This study is the first detailed analysis of the career path of Latin American CFOs, their academic and professional experience, hiring background, nationality, gender and tenure, among other variables.

Our research goes beyond public information; rather, we have studied each individual's background since the beginning of their careers. This has enabled us to identify patterns and determine the relevant experience for potential CFOs.

This study concentrates on career histories prior to being appointed CFO for the companies that are part of the Colombian COLCAP Index, which includes the 20 most liquid stocks listed in the Bolsa de Valores de Colombia (BVC).

Merval is the main index of the Buenos Aires Stock Market Exchange. The selection criteria for these stocks is based on the volume traded and the number of transactions in the last six months. The rebalancing of the Merval is done quarterly.

B3 - Bovespa Mais, Bovespa Mais Nivel 2, Novo Mercado, Nivel 2 and Nivel 1 were created in order to develop the Brazilian capital market. To make this index, it was necessary to have segments suitable for the different company profiles. All of these segments are valued by differentiated corporate governance rules. These rules correspond to the companies’ obligations under Brazilian corporate law and are intended to improve the evaluation of those that voluntarily join one of these listing segments.

Chile Indice de Precio Selectivo de Acciones (IPSA Index) is the main stock exchange index of Chile. For the first quarter of 2018, this index was composed by the 40 stocks with the highest stock market presence.

The S&P/BMV Indice de Precios y Cotizaciones (IPC) seeks to measure the performance of the largest and most liquid stocks listed on the Bolsa Mexicana de Valores. The index is designed to provide a broad, representative, yet easily replicable index covering the Mexican equities market. The constituents are weighted by modified market cap subject to diversification requirements.

Peru Select Index is designed to measure the performance of the largest and most liquid stocks listed in the Lima Stock Exchange (Bolsa de Valores de Lima S.A. or BVL).

To view the list of Colombia COLCAP companies, download the full report.