Spencer Stuart has spent the last five years analysing the backgrounds and demographics of CFOs in FTSE 350 companies. Through our detailed knowledge of CFO career paths we offer a unique insight into CFO hiring trends. This report contains some of our latest findings.

Around 20% of companies change their CFOs each year. With the spotlight falling on diversity among senior executives, this year’s data shows that when hiring a CFO to sit on the main board the nomination committees of public companies remain conservative and are generally reluctant to hire promising, unconventional candidates. The balance of power between clients and candidates is changing. The market has become increasingly competitive over the past 12 months and the best candidates are often considering multiple opportunities at any one time. As a result of this shift in supply and demand companies are having to consider the trade-offs; for example, it may not be realistic for a FTSE 250 company to insist on hiring a proven plc CFO. Indeed, only 45% of FTSE 250 CFOs had CFO experience before being appointed to their current role.

Executive Summary

Combining the data from our research with our extensive experience working with FTSE100 and 250 boards on CFO succession planning, we have identified three areas for nomination committees to focus on:

- Diversity. The UK CFO market is dominated by white, British men. Until boards begin to make bolder and perhaps less conventional hiring decisions this is unlikely to change in the short term.

- Power swing. The market is no longer at the client’s beck and call. The balance of power has shifted to the candidate. Companies are having to move faster and be more aggressive and decisive to acquire the best talent.

- Bullish outlook. The UK CFO market is defensive and conservative but also highly active. We don’t see any likelihood of the market slowing down in the near term.

The findings outlined in this paper are indicative of the data-driven approach that we take to advising clients and candidates. If you would like further information on CFO succession planning please contact our team of UK- based consultants (see page 7).

How diverse are FTSE 350 CFOs?

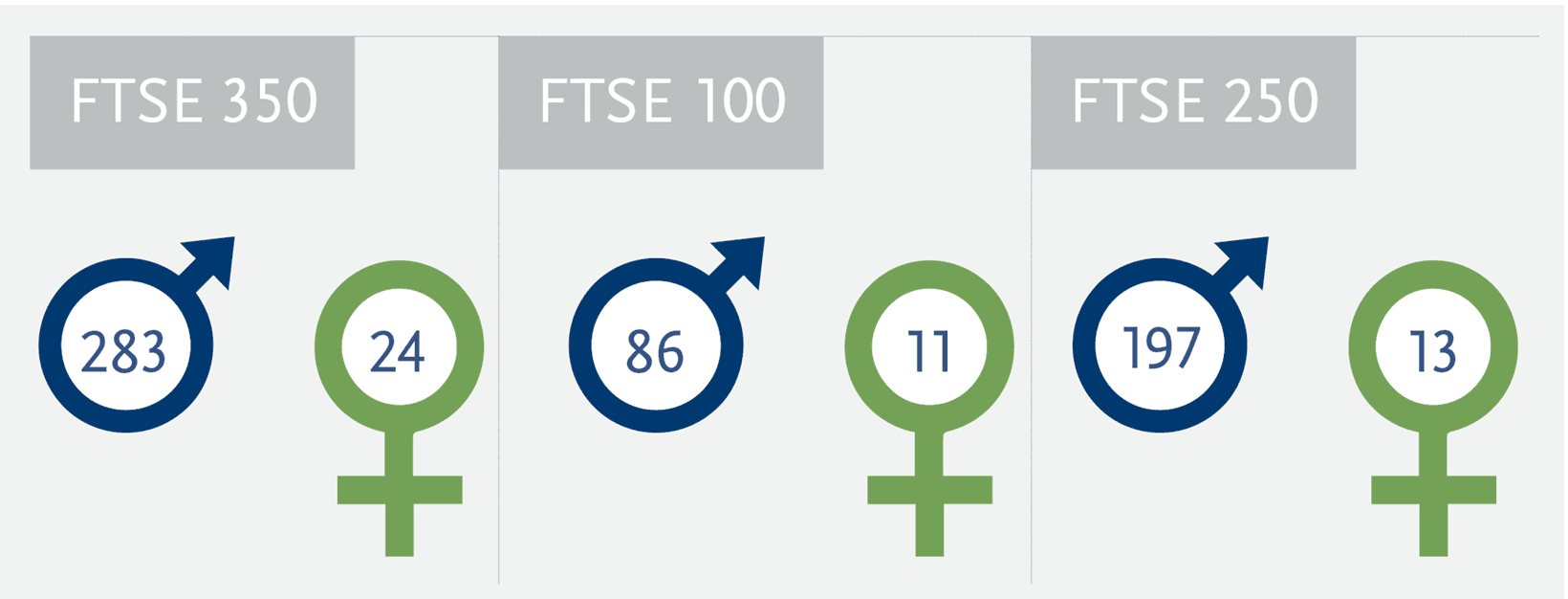

Gender diversity among CFOs is extremely low in FTSE 350 companies. At the most senior levels there is a finite number of high-quality female finance executives; we find them to be more thoughtful and risk averse than their male counterparts when it comes to their own career planning.

Clients are increasingly focusing on diversity when hiring direct reports to the CFO; this gives us grounds for optimism that the number of female CFOs will grow over the longer term. Indeed, companies are paying much more attention to the CFO’s ability to develop an outstanding function and build a diverse talent pipeline.

8% of FTSE 350 CFOs are women

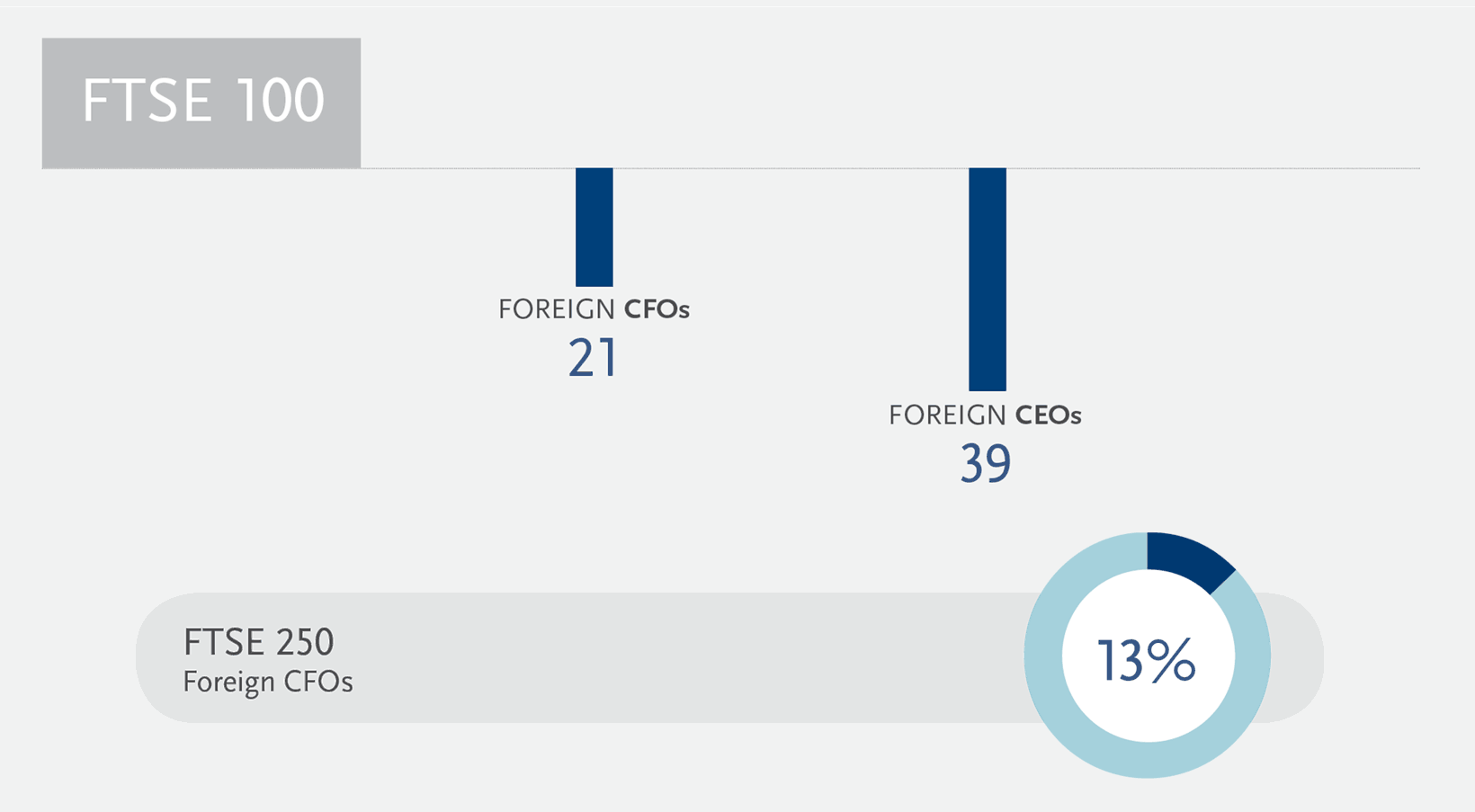

An increasing number of foreign chairmen and CEOs run FTSE businesses but boards still prefer British CFOs. This is partly due to the perception that British accountants have more rounded skills than their international peers and partly due to the innate conservatism of UK plc. That said, with the exception of Switzerland, all the major markets in Europe have an overwhelming number of ‘local’ CFOs, as do most companies in the US.

16% of FTSE CFOs are non-UK nationals

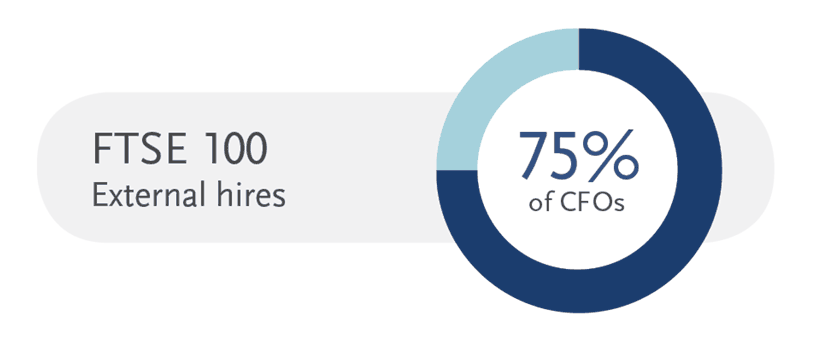

Internal vs. external hires

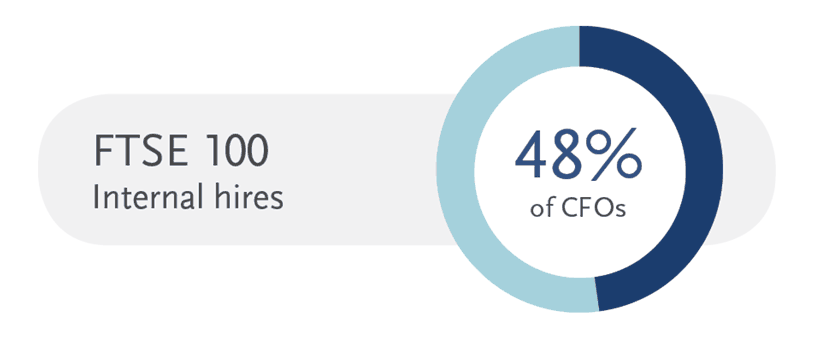

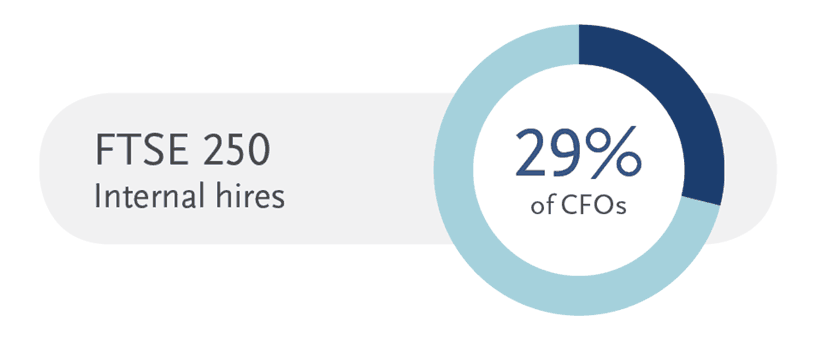

FTSE 100 companies are far more likely to promote their CFO from within. Consumer and TMT companies top the bill, with 60% of CFOs appointed internally. FTSE 250 companies tend to have smaller finance departments which provide fewer opportunities for high potentials to gain broad functional exposure.

35% of FTSE CFOs were internal hires

External hires - relevant sector experience

When a decision is made to recruit externally, companies prefer to appoint a CFO with experience in the same sector. Life sciences companies and FTSE 100 industrial companies are more open to recruiting from outside the sector.

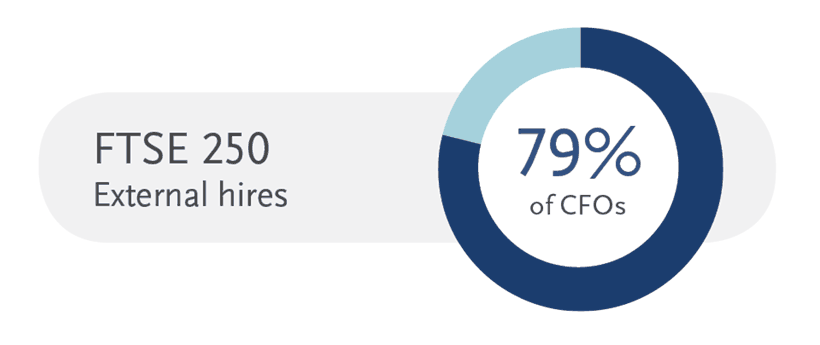

Professional background

Experience in divisional and group roles is important for FTSE 100 CFO candidates. On the whole, FTSE 250 CFOs have less exposure to group roles, although a higher percentage come from professional services backgrounds. Contrary to popular belief, very few CFOs have held hands-on, dedicated investor relations roles.

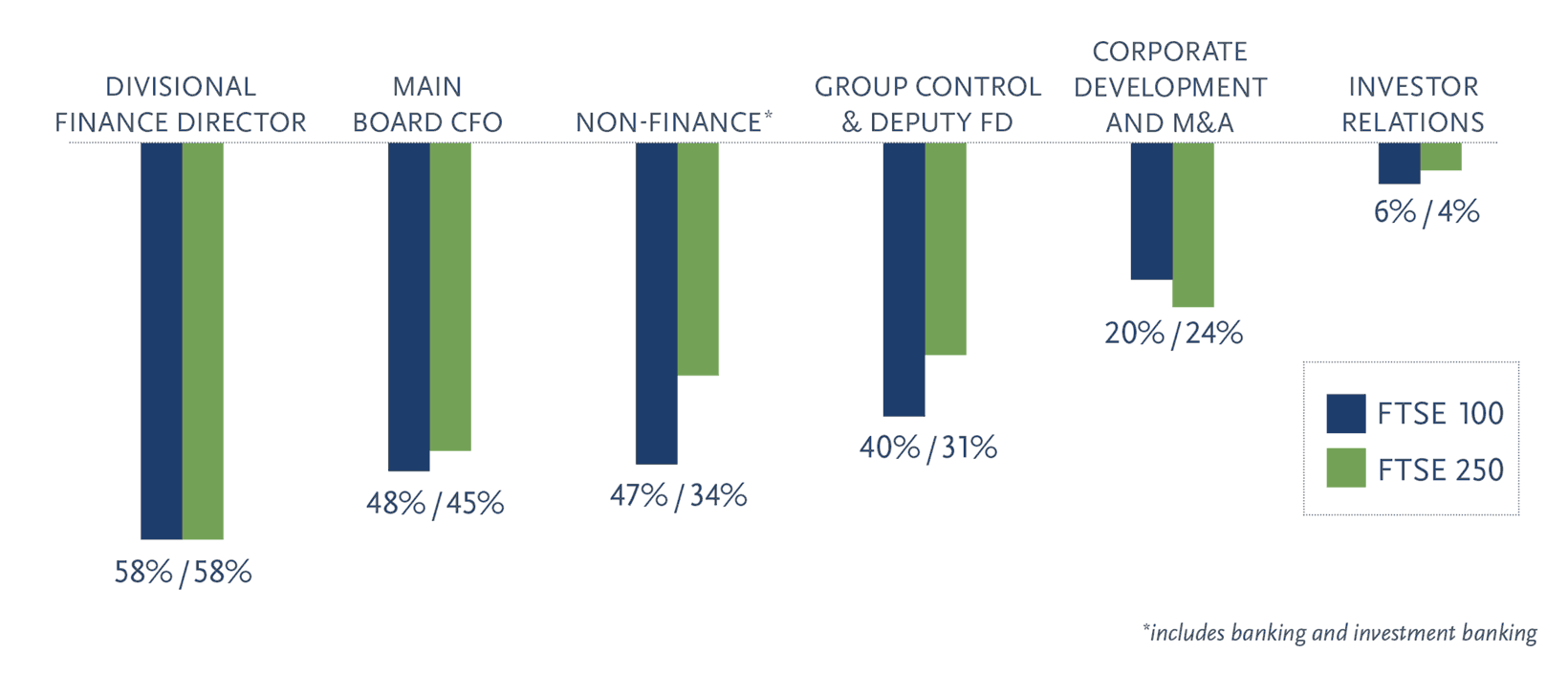

CFO tenure

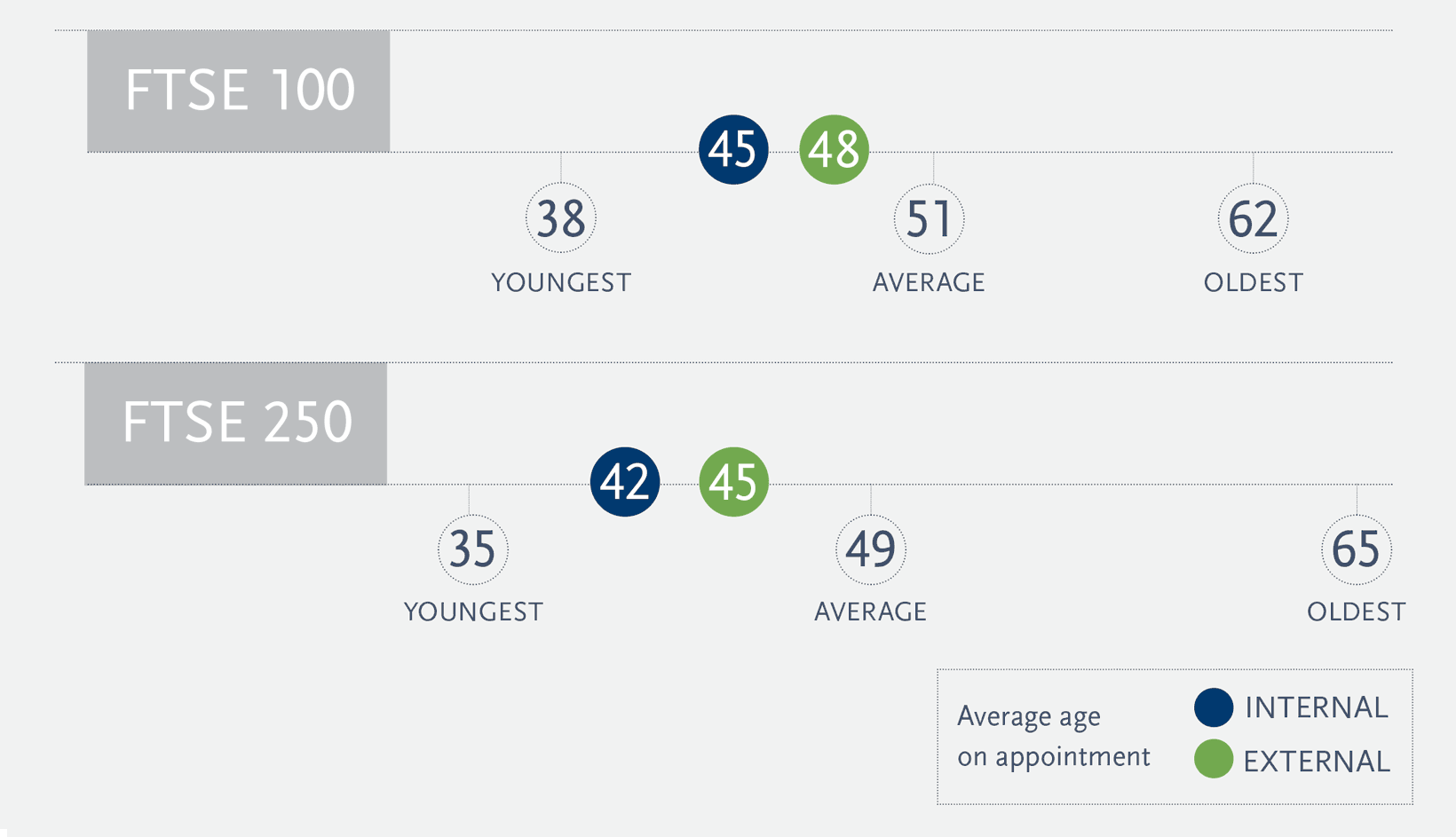

Age of CFOs

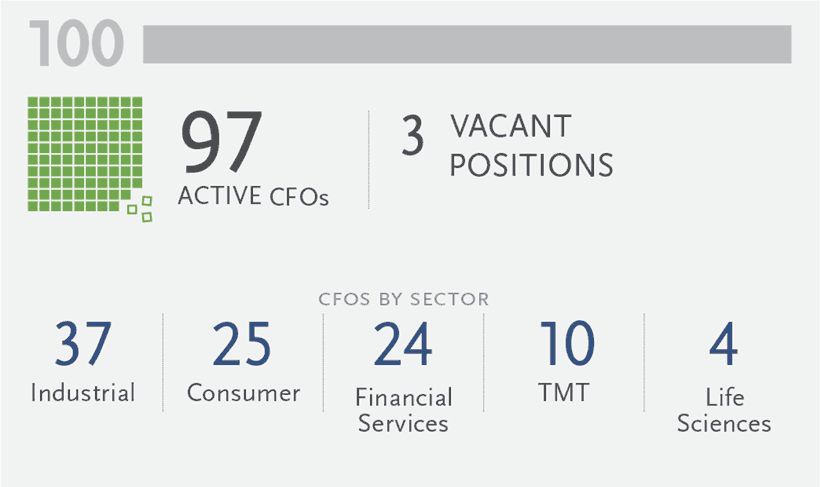

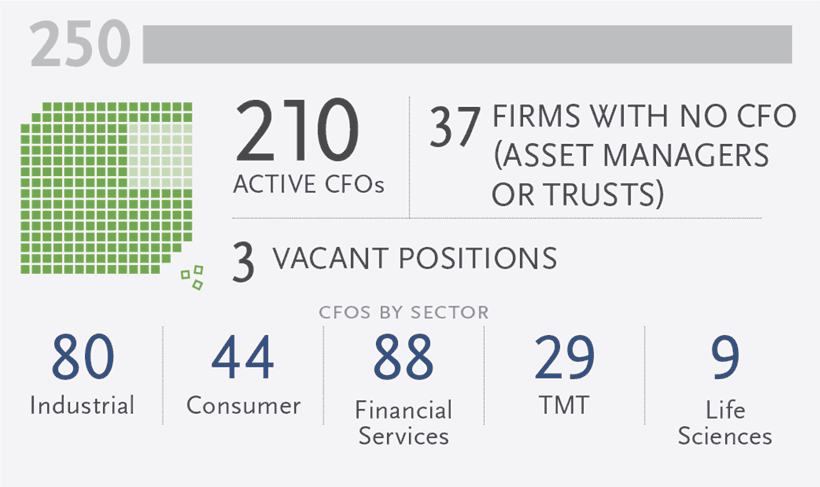

Composition of FTSE 100 & 250 *

* at the time our data was collected