To get a sense of the mood within boardrooms across the globe, we

recently conducted an in-depth survey of directors worldwide. In light

of Australia’s election in early July, we went back to reexamine

Australian directors’ responses to see what they were thinking in the

months leading up to the vote.

Released in April, the 2016 Global Board of Directors Survey was

produced by Spencer Stuart, the WomenCorporateDirectors (WCD)

Foundation, Professor Boris Groysberg and doctoral candidate Yo-Jud

Cheng of Harvard Business School, and researcher Deborah Bell. The

survey collected responses from more than 4,000 male and female

directors from 60 countries, within many of the world’s top public and

large, privately held companies.

The study explores how boards think and operate, and captures the

governance practices, strategic priorities and views on board effectiveness

of corporate directors around the world. The growing demands

on corporate boards are transforming boardrooms globally, with directors

taking on more strategic, dynamic and responsive roles to help

steer their companies through a hypercompetitive and volatile business

environment. Economic and political uncertainties make

long-term planning more difficult, and the proliferation of cyber-attacks

— and their consequences for business in financial losses and reputational

damage — increases the scope of risk oversight.

With regards to Australia, our results found some compelling differences

between directors there and their counterparts across the world.

Some highlights include: Australian directors are more likely than

directors elsewhere to be concerned about the economy and political

instability, and they view customer influence as a much larger factor

than their global counterparts.

Feeling global concerns

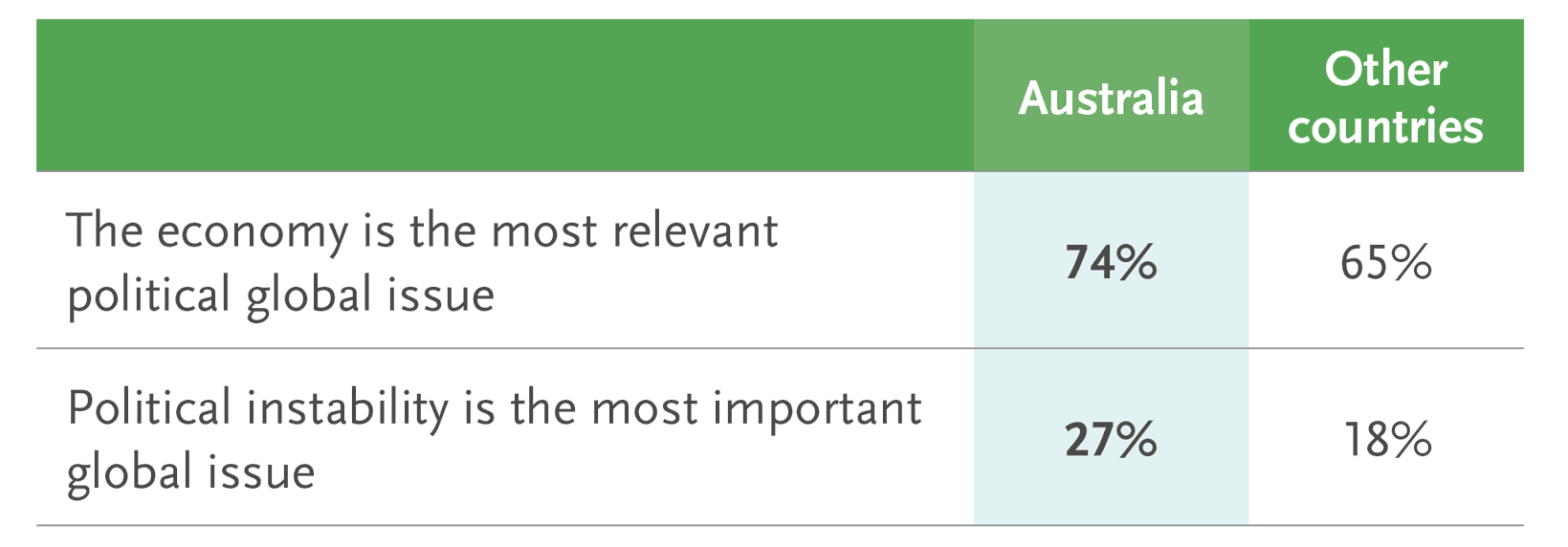

When it comes to pressing international concerns,

Australian directors feel the global political environment

and the economy are the most important issues.

Seventy-four percent of Australian directors cite the

economy as a key political issue, compared with 65

percent of directors globally. Meanwhile, 27 percent of

Australian directors rank political instability as a leading

issue, versus 18 percent of directors globally.

Bullish on developing countries

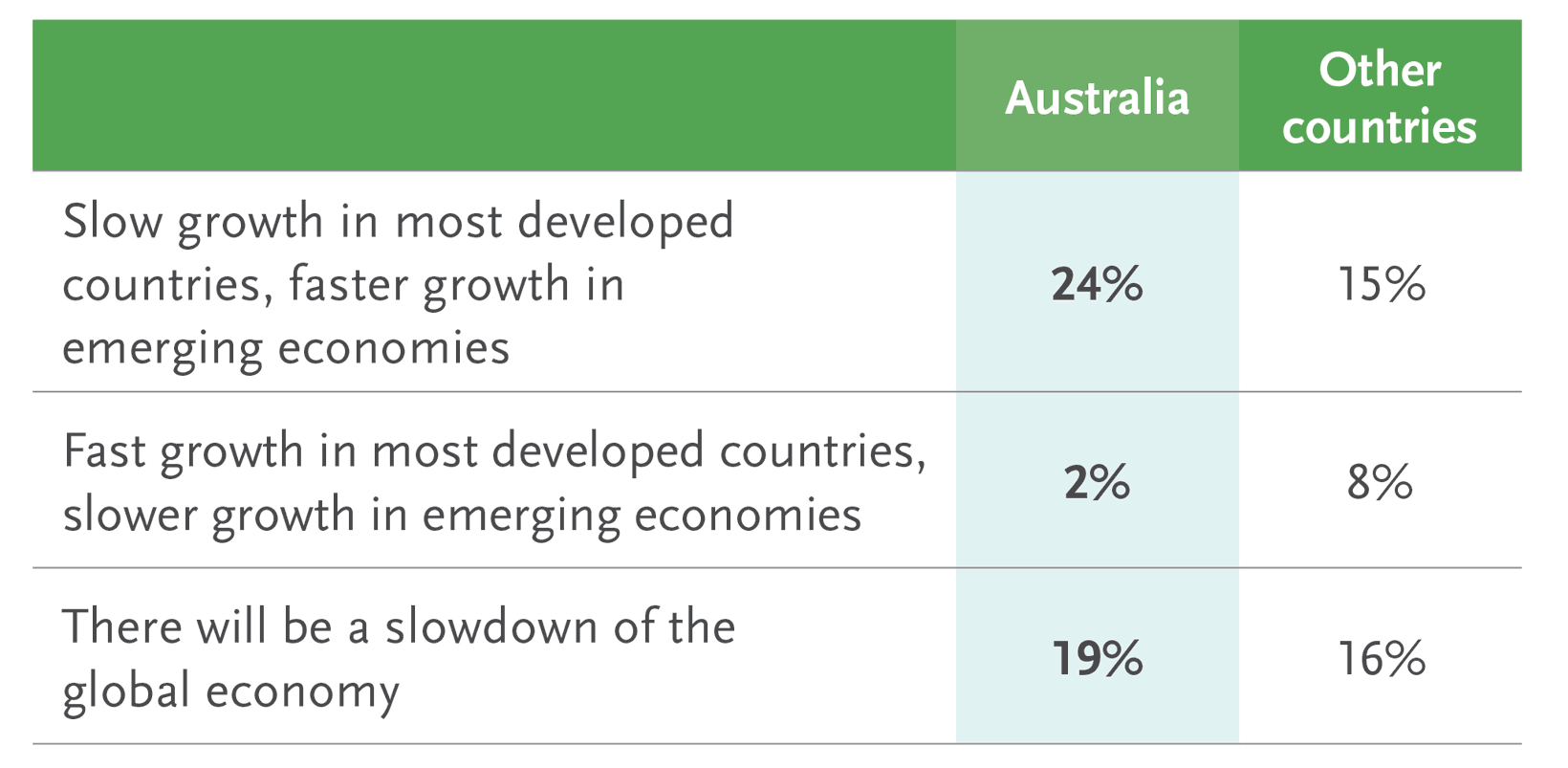

Despite Australian directors’ concerns about the global

political/economic situation, they are more optimistic

about growth prospects in emerging economies. Nearly

one-quarter of Australian directors (24 percent versus 15

percent of all directors) expect slow growth in most

developed countries, but faster growth in emerging

economies. Similarly, Australian directors are much less

bullish about rapid growth in developed economies —

only 2 percent of Australian directors foresee fast growth

in developed countries and slower growth in emerging

economies, compared with 8 percent of global directors.

Overall, Australian directors are not especially optimistic

about the world’s economy — 19 percent predicted an

economic slowdown on a global scale, compared with

16 percent of other directors.

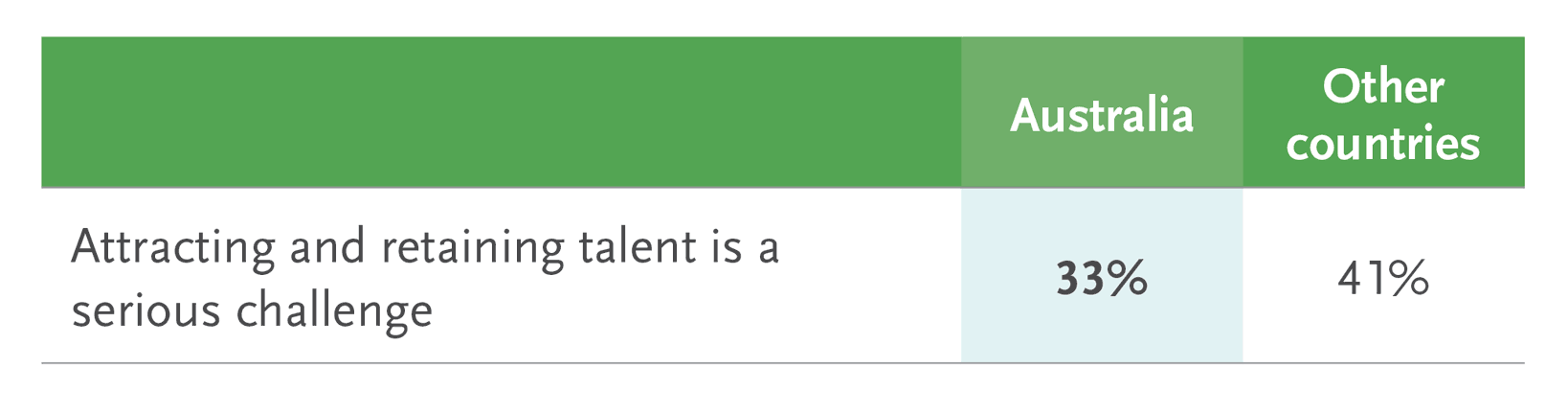

Facing more local issues

In addition to global concerns, Australian directors also

see significant challenges arising within their borders.

Forty-six percent say the regulatory environment is one

of the top challenges to achieving strategic objectives,

compared with 39 percent of global directors. They also

see domestic competitive threats as a bigger issue than

their global peers, 35 percent compared to 29 percent.

“Political and economic uncertainty is being felt in the

nation’s boardroom,” Kevin Jurd, who leads Spencer

Stuart’s Board Practice for Australasia. “At the same

time, board directors also tell us they feel the regulators

are getting tougher and more rigorous, which is driving

up the time boards must spend on compliance versus

strategic discussions at this important time.”

Putting the customer first

Australian directors express higher concerns about

consumer demand, citing customers as stakeholders in

their companies (70 percent) much more frequently

than directors in other countries (52 percent). Australian

directors rate the level of influence that customers exert

over their companies as being second only to investors/

shareholders. Similarly, Australian boards are much

more likely to cite the community (63 percent in

Australia vs. 37 percent worldwide), government (54

percent vs. 31 percent) and workers’ unions (26 percent

vs. 15 percent) as stakeholders in the company as

compared to other boards worldwide.

Promoting board turnover

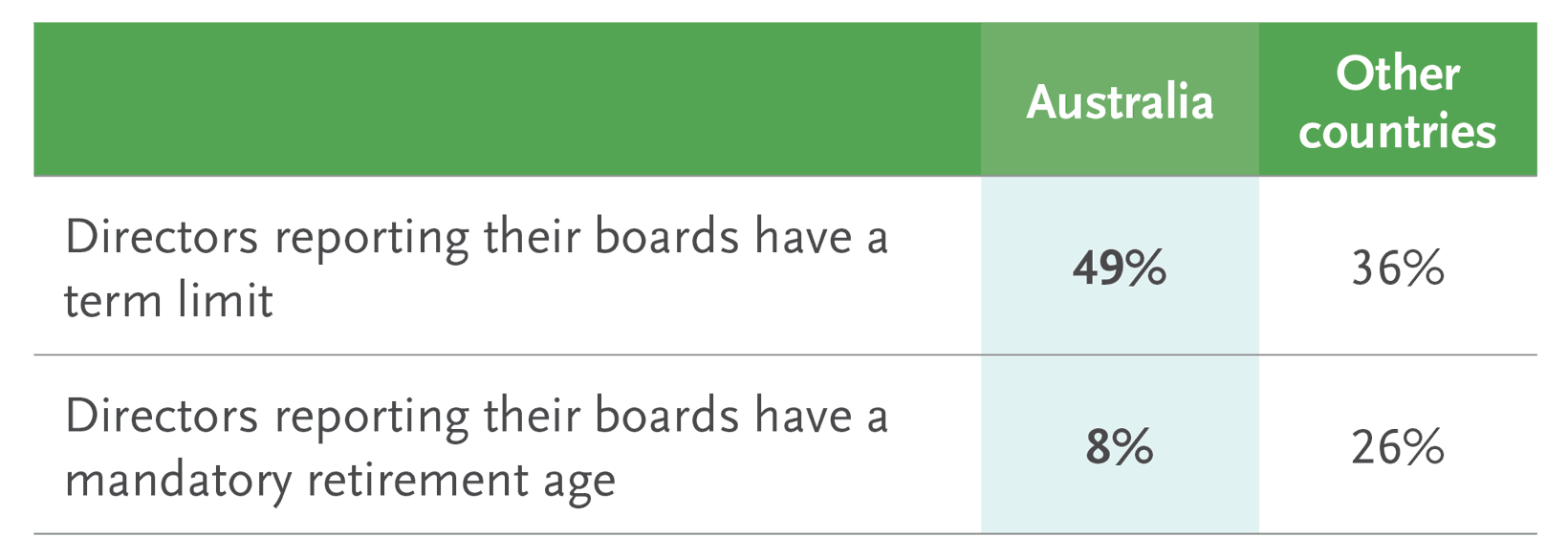

In order to encourage renewal on the board level, directors

in Australia lean toward term limits over mandatory

retirement: Nearly half of Australian directors report that

their boards have a term limit (49 percent versus 36

percent of directors globally), while 63 percent support

term limits (compared to 60 percent globally). This

difference between the actual practice of term limits and

the support for them could indicate that Australian

boards will take on this issue down the road.

Another finding indicates only 8 percent of Australian

directors said their board has a mandatory retirement

age, compared with 26 percent globally. Only 19 percent

of Australian directors said boards should have a

mandatory retirement age versus 45 percent of directors

globally. Australian directors also feel more strongly than

directors globally that board members lose their independence

after a certain number of years, 56 percent

versus 43 percent.

Along those lines, Australian directors are more independent

than their global counterparts (74 percent

versus 67 percent) and have a higher renewal rate (16

percent of Australian directors were appointed in the

past 12 months, compared with 13 percent).

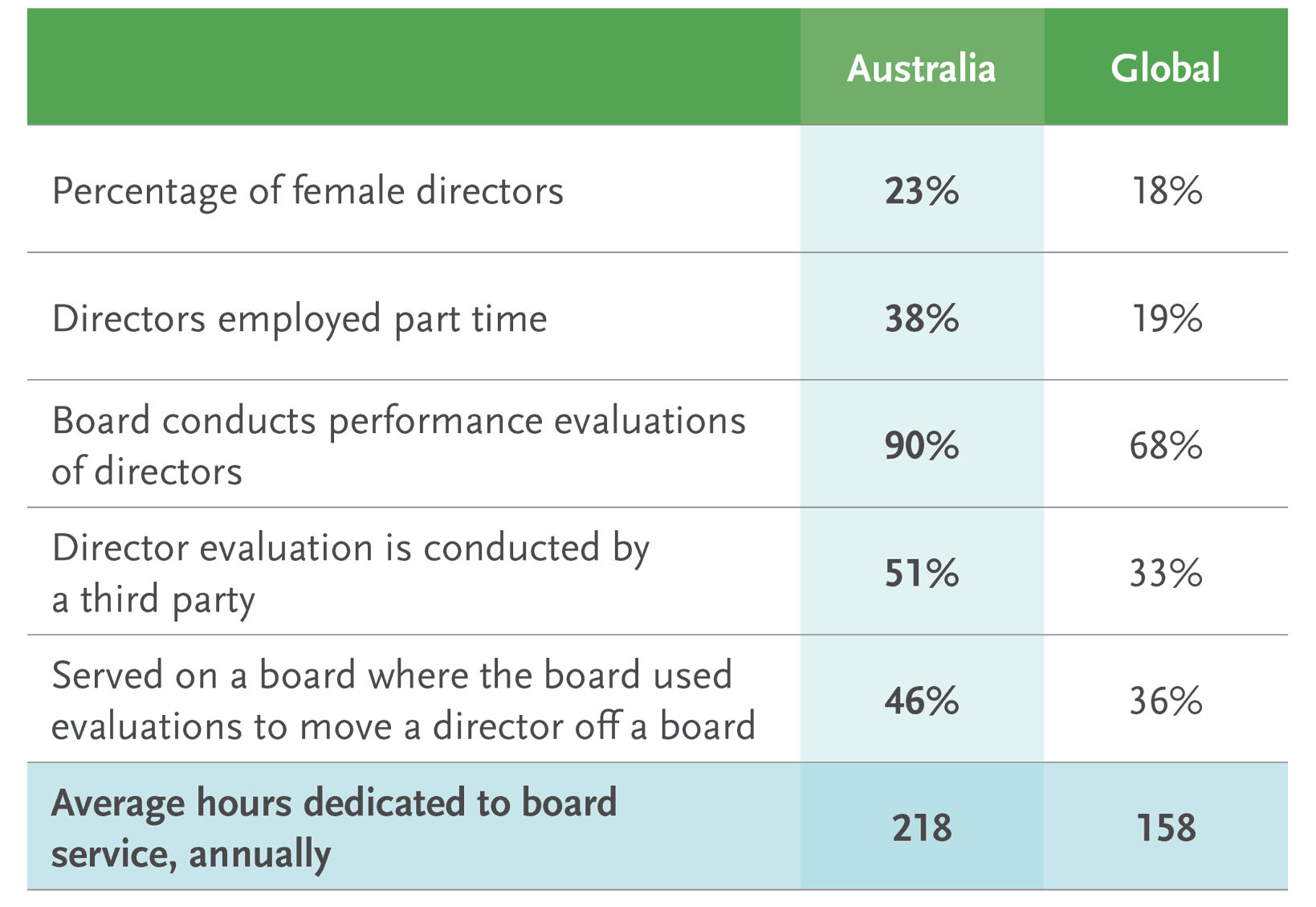

Ninety percent of Australian directors reported their

board conducts a performance evaluation of individual

directors, and among those boards, 51 percent use a

third-party to facilitate board assessments. Forty-six

percent have served on a board where the evaluation has

been used to move a director off the board. Australian

boards also have a greater representation of women

than the global average; 23 percent of Australian directors

are women, as opposed to 18 percent worldwide.

As a result of their system, Australian boards keep

more experienced directors and maintain strong institutional

knowledge, while also ensuring boards cycle in

new members for fresh perspectives. “When implementing

term limits, Australian directors emphasize

the importance of staggering appointments so that

there is a progressive and predictable cycle of renewal,”

notes Cheng.