Since the financial crisis, the role of the chief financial officer has grown in scope and complexity. To examine how the profile of CFOs from the leading companies in the Netherlands has changed over the past decade, Spencer Stuart and Vrije Universiteit Amsterdam embarked upon a rigorous analysis of the careers of CFOs to better understand what has prepared them for the leadership positions they now occupy.

Our research produced a wealth of fascinating data about the routes CFOs have taken to reach the top. This paper pays particular attention to CFOs’ background, functional experience, diversity, education and professional qualifications.

Internal vs. external hires

The proportion of CFOs hired from outside the company has decreased slightly over the past decade, from 65% in 2007 to 63% in 2017. Internal hires have an average of 11 years’ experience in the company prior to becoming CFO.

Previous experience

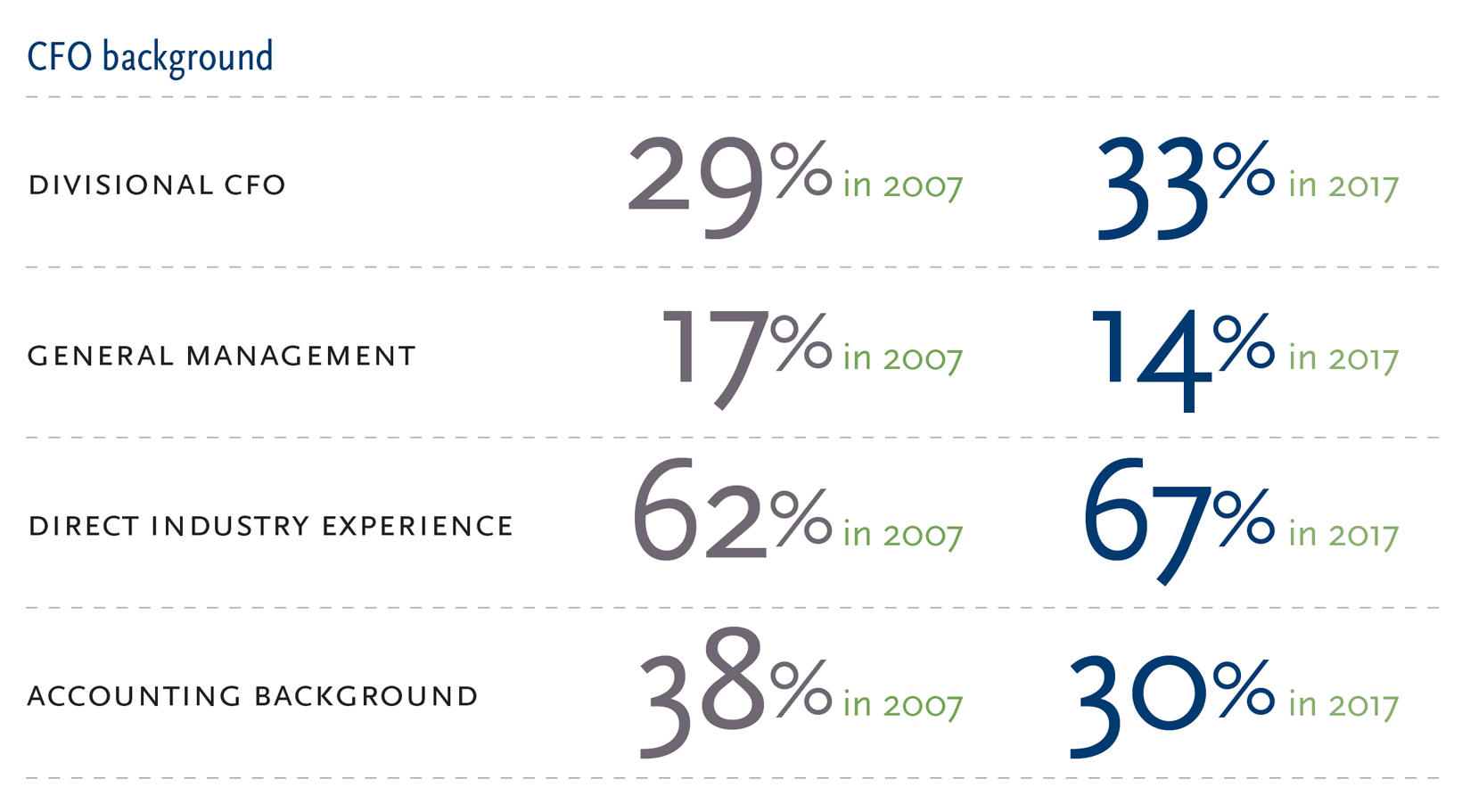

Compared with CFOs a decade ago, today’s cohort of CFOs came into their roles having acquired far broader experience both inside and outside the finance function.

Given the growing complexity of the CFO’s role and its importance to the organisation, it is somewhat surprising that the proportion of CFOs with previous experience in the top finance role has remained constant at 29%. However, the fact that over two-thirds of appointments went to first-time CFOs should encourage the next generation of senior finance professionals coming through the ranks.

57% of CFOs have some international experience prior to their appointment. Compared with their 2007 counterparts, today’s generation of CFOs came to the job with more experience operating at both a country and regional level; they were also more likely to have worked at divisional as well as business unit level.

Methodology

This study is the first detailed analysis to look at the trajectory that leading Dutch CFOs have taken en route to the top, comparing the 2017 cohort with CFOs who were in place in 2007. Our in-depth research draws on information in the public domain and on our knowledge of the backgrounds of individual CFOs. This has enabled us to examine specific roles that CFOs have undertaken within the finance function (and outside of it), identify patterns and determine what experience is most valuable and relevant in the formation of potential CFOs in the Netherlands.

The 2007 data is based on an analysis of 44 companies comprising 24 members of the AEX, the 11 largest businesses in the AMX and the nine largest family-owned companies. One AEX company was excluded on the basis that it did not have activities in the Netherlands.

The 2017 data is based on an analysis of 45 companies comprising 22 members of the AEX, the 13 largest businesses in the AMX and the 10 largest family-owned companies. Three AEX companies are excluded on the basis that they do not have activities in the Netherlands.

We excluded from our analysis state-owned enterprises. In terms of ranking, our selection of companies is based on sales revenues rather than market capitalisation, on the basis that this a better indication of complexity from a CFO perspective. The average revenues of the companies featured in the 2017 data is €21.8 billion, compared with €16.7 billion for the 2017 companies. 31 companies feature in both data sets.

Whereas slightly more of today’s CFOs came directly from a divisional CFO role, fewer

CFOs were appointed from a general management position.

There is greater demand for CFOs with experience of the same industry. What’s more, our research shows that the current cohort of CFOs bring a broader set of business skills to the role compared with their counterparts in 2007. The greatest difference is to be found in IT where 59% of today’s CFOs have previous management experience compared with 38% of CFOs who were in situ in 2007. CFOs today are also more likely to bring expertise in financial control, M&A and risk management. By contrast, CFOs today are less likely to have direct expertise in internal audit and compliance.

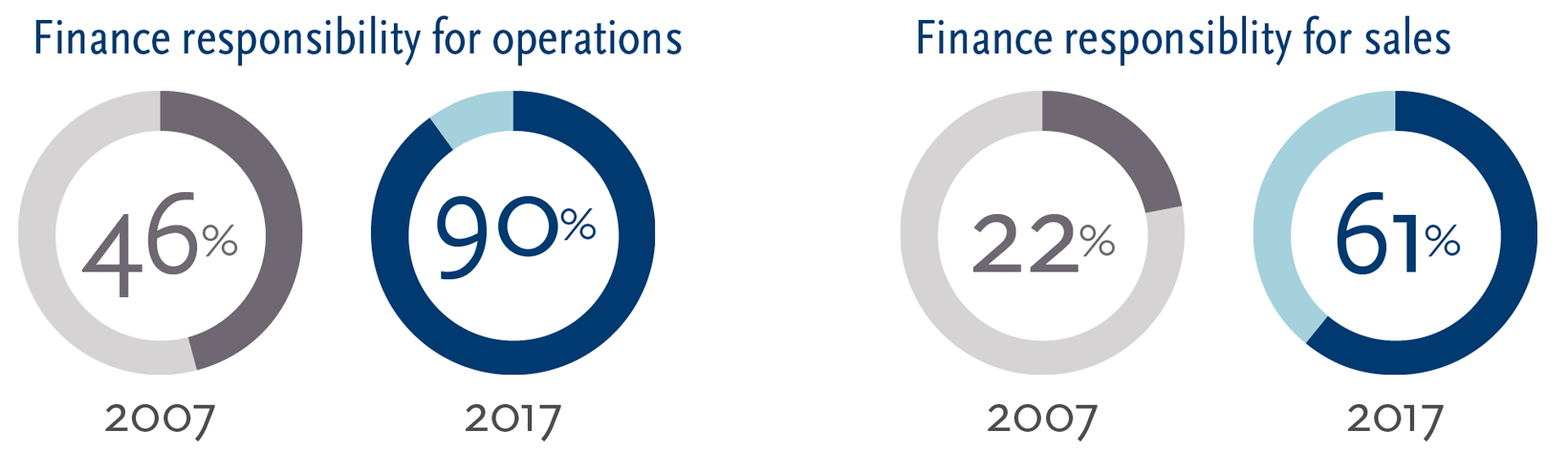

The number of CFOs who have had finance responsibility for operations (e.g. manufacturing and supply chain) has doubled over the past decade from 46% to 90%. The number of CFOs with finance responsibility for sales has also risen dramatically, from 22% to 61%.

Development areas for companies to consider

We continue to be surprised by how many large organisations do not focus on finance talent management with an eye to CFO succession. Only 37% of current Dutch CFOs were promoted from within, compared with 48% of FTSE 100 CFOs. We recommend that companies should be regularly reviewing their pipeline of high-potential finance professionals, steering them towards the kind of roles that will position them to be credible candidates for CFO when the time comes. We recommend that companies ask themselves the following questions:

- How do we expose high potentials to the challenges of high top-level communication and stakeholder management?

- How do we make sure that our best finance professionals do not fall into the “specialisation trap”? How can we develop their skills and experience by offering them business or functional roles outside their comfort zone?

- How do we rotate high-potentials through roles in the corporate centre?

- How do we help finance professionals gain international exposure, especially experience living and working abroad?

- How do we encourage gender diversity at all levels within our finance organisation?

- How do we foster international diversity within the finance function?

Beyond the domain of finance, today’s CFOs are more likely to have acquired expertise in supply chain and operations/manufacturing, although in line with our 2007 findings, 40% have held general management positions prior to becoming a CFO.

In terms of sector experience, the number of CFOs with a background in either banking or consulting has increased by 50%, whereas there has been a reduction in the number of CFOs who have worked in an accounting firm.

In summary, companies are increasingly looking for CFOs with broader backgrounds. They increasingly value strategic finance skills over technical accounting and auditing skills, but with the proviso that the CFO is supported by a finance function comprising the necessary talent and expertise to cover each of these areas.

Diversity

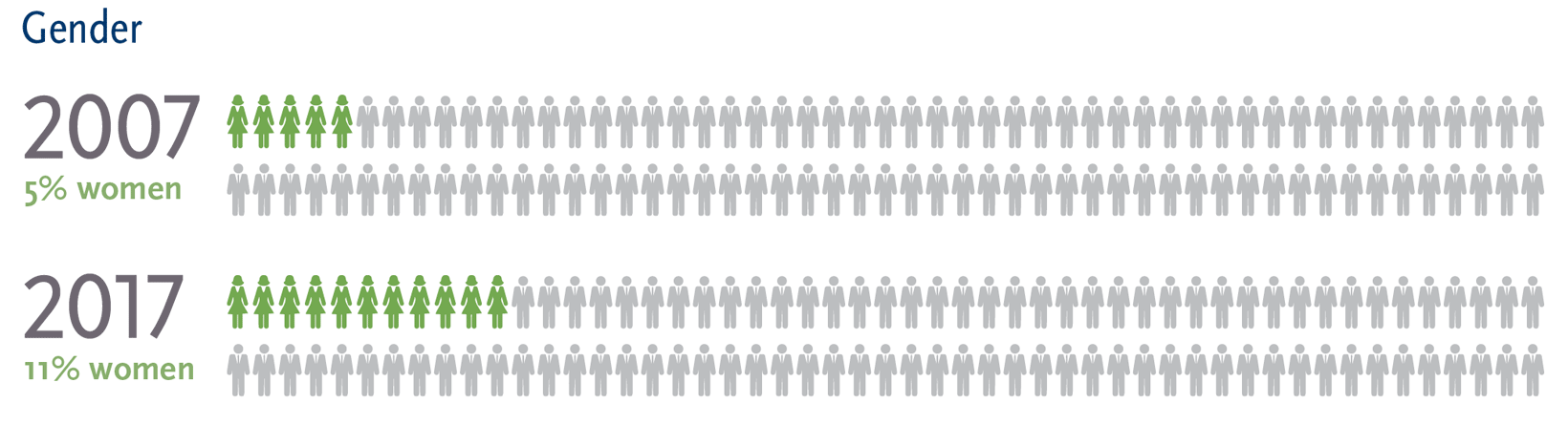

According to most measures, today’s CFOs are more diverse than their counterparts a decade ago. The proportion of female CFOs has doubled, but from a low base — CFOs themselves need to play their part in addressing this gender imbalance by helping women throughout the finance organisation to develop their careers.

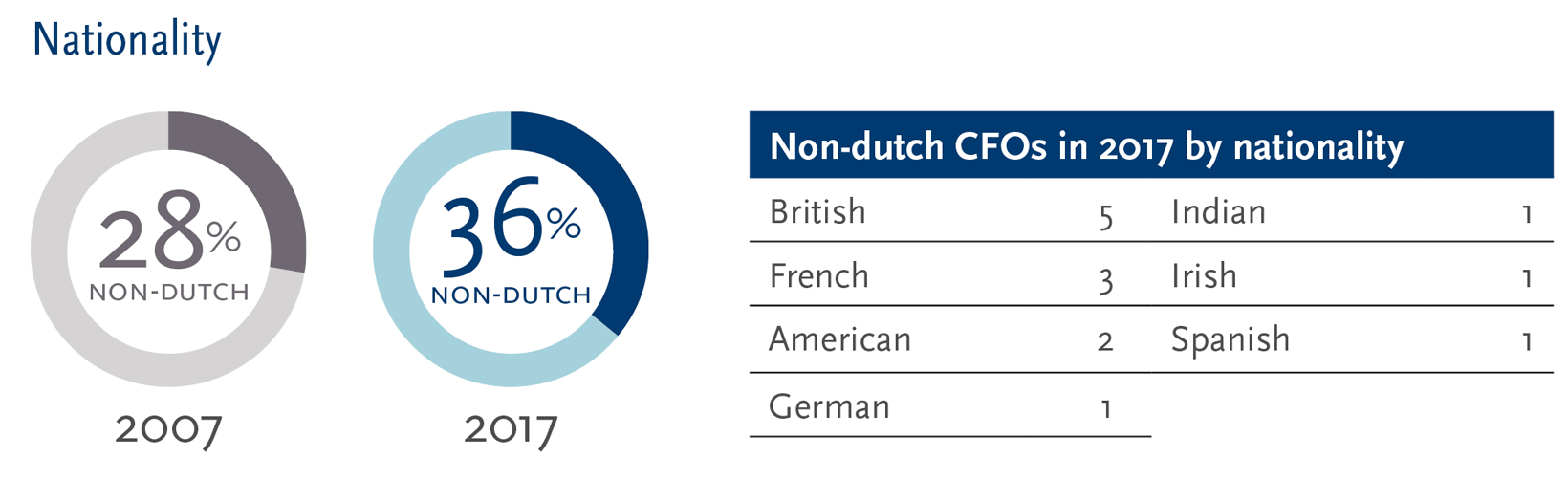

There has been a rise in the number of non-nationals appointed as CFOs of leading Dutch companies. Of the non-Dutch CFOs, 21% are French and 36% are British. 14% of non-national CFOs are North American, down from 17% in 2007.

Age and tenure

At the time they were hired, today’s group of CFOs were slightly younger than the 2007 group on average: 68% were aged between 40–49 at the time of their appointment compared with 52% of the 2007 CFOs. At the cut-off point for our research, however, the situation was reversed: the average age of current CFOs was 51, two years older than CFOs in 2007. The principal reason for this reversal is the fact that the CFO tenure is longer today than it was a decade ago.

Education

The proportion of CFOs with a bachelor’s degree in economics or business administration has declined from three-quarters to two-thirds over the past decade. By contrast, CFOs with a bachelor’s degree in science have increased from 6% to 25%.

80% of today’s CFOs with a masters degree studied economics or business administration. Slightly fewer CFOs have a masters degree (76% vs. 79%), but those without a masters have generally acquired a professional qualification such as a CPA or CMA/CIMA degree. 80% of today’s CFOs with a masters degree studied economics or business administration. Although some CFOs chose to take some classes abroad, most have acquired their international experience in the workplace rather than in academia.

Over two-thirds of current CFOs have a post-masters qualification; of these, 22% gained a Registered Controller (RC) degree. The shift from RA to the post-masters, high-level RC qualification is significant and a further indication of how the CFO role is developing towards a greater focus on business analytics and the value chain. Nearly all these qualifications came from just six institutions: CIMA, Erasmus University Rotterdam, ICAEW, INSEAD, NIVRA, and Vrije Universiteit Amsterdam.

CFOs with RC or equivalent qualification

5% in 2007 → 22% in 2017

Growing responsibility for CFOs

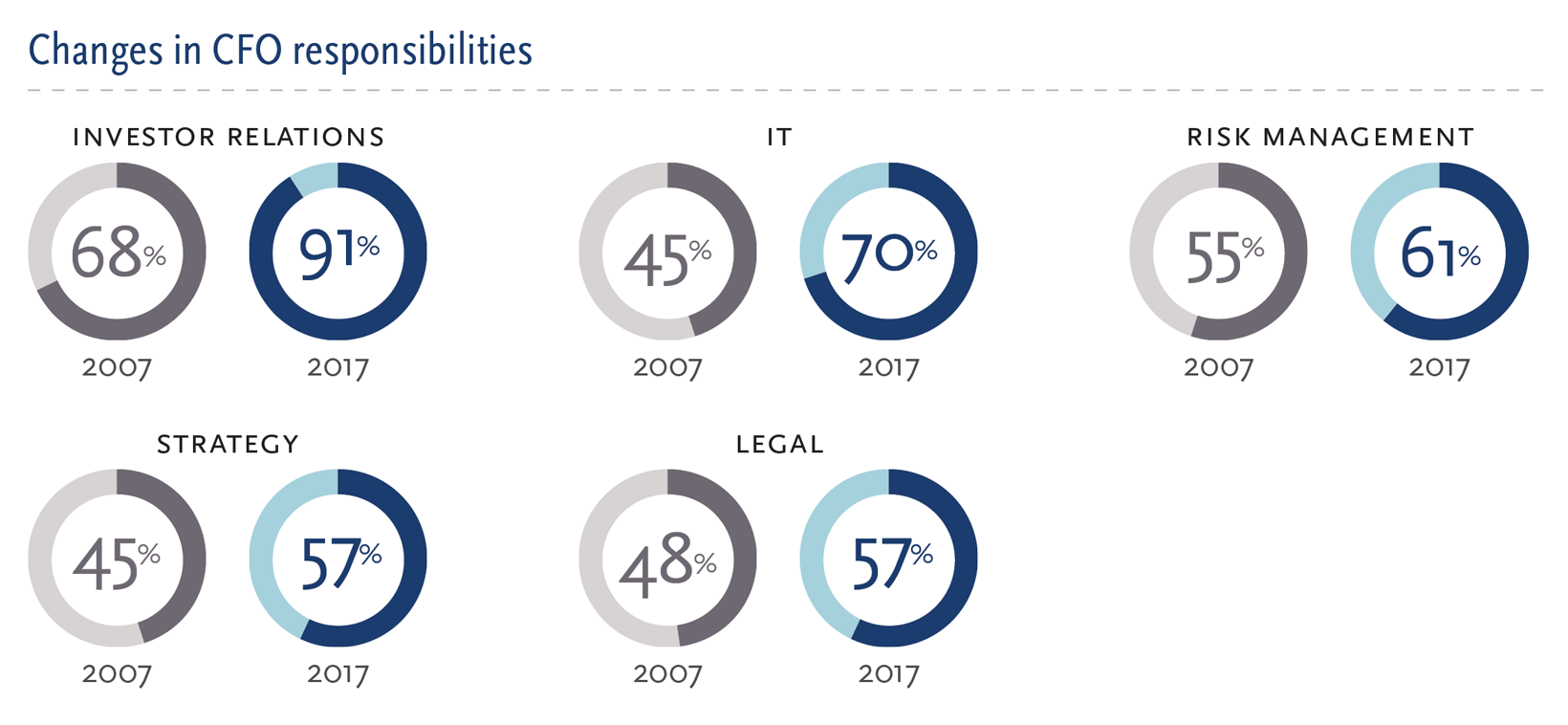

There has been an increase in the functional areas for which CFOs are responsible, although the scope of the CFO’s role will always depend on the characteristics and circumstances of each business. Compared with 2007, more CFOs in 2017 have explicitly stated their responsibility for strategy, legal affairs and risk management, however the functions where CFOs have grown their remit the most are investor relations and IT.

Conclusion

The CFO role is becoming more strategic, and this is borne out by the growing number of companies that have broadened their CFO’s responsibility to include strategy, IT and risk management. CFOs are being drawn from a more diverse slate, with the number of female and foreign CFOs on the increase. Although CFOs are being appointed younger they are enjoying longer tenure in the role. The educational background of CFOs is becoming more diverse, although some kind of post-graduate study is becoming increasingly common. An early career in the accountancy profession has become less relevant, but there is a growing emphasis on the Registered Controller qualification. In summary, CFOs today are not only functional leaders, but bring a breadth of experience and expertise to the role that one might expect of a COO. Above all, they are becoming invaluable business partners to the CEO.