June 7, 2017

NGOs: The CEO Profile You Might Need to Drive Financial Efficiency

In recent times, the nonprofit sector has seen its resources — especially those derived from traditional fundraising sources — grow increasingly scarce. We are also seeing a shift to partnerships between international donors, partner governments, the private sector and beyond that move money in new and different ways.

The critical mandates for nonprofit CEOs today are to diversify and, ideally, bolster the organization's fundraising strategy while minimizing risk. At the same time, successful international non-governmental organizations (NGOs) have continued to grow, and they are not necessarily right-sized to effectively execute against a new strategy. For growing organizations and those looking to disrupt their current models, experience leading global enterprises facing these same kinds of challenges has become even more important, but is harder to find outside of the private sector.

Of course, the most successful international NGO CEOs possess a wide range of experiences and skills, including the ability to connect with and influence a wide group of stakeholders. But, in a challenging funding environment, one skill in particular is becoming crucial: the ability to drive financial efficiency. Is there a certain type of leader who is likely to be most successful accomplishing this mission? Quite possibly.

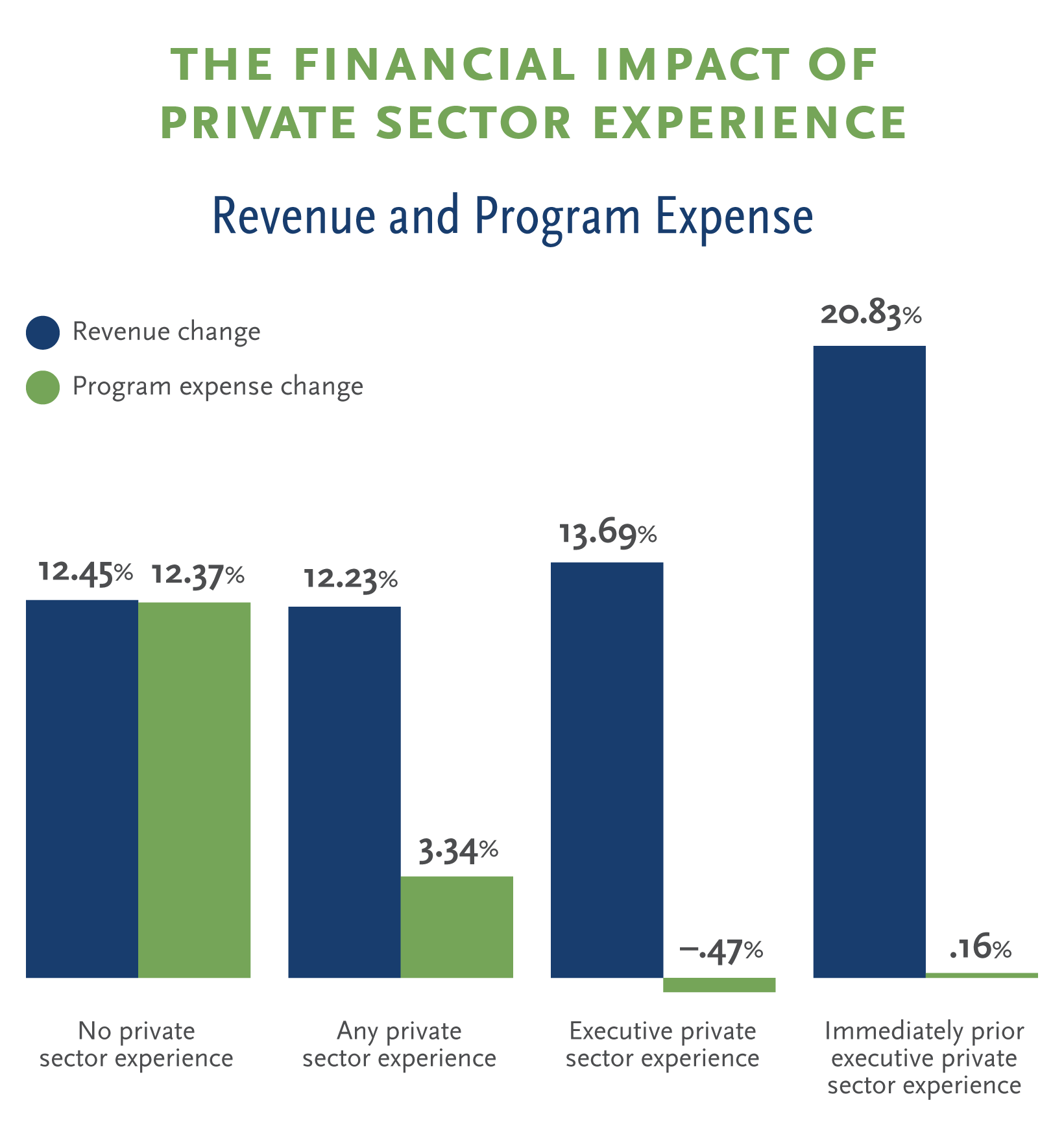

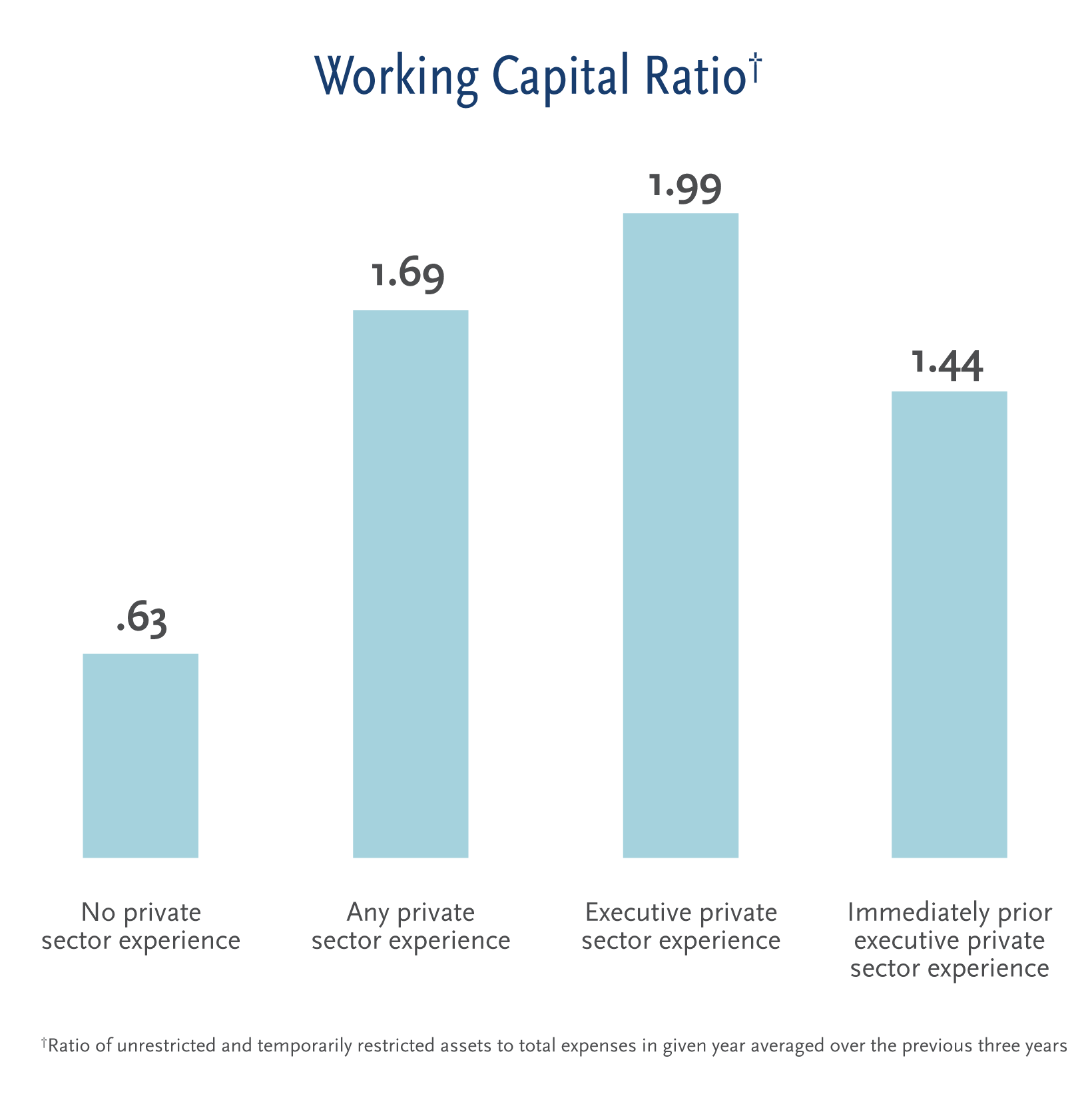

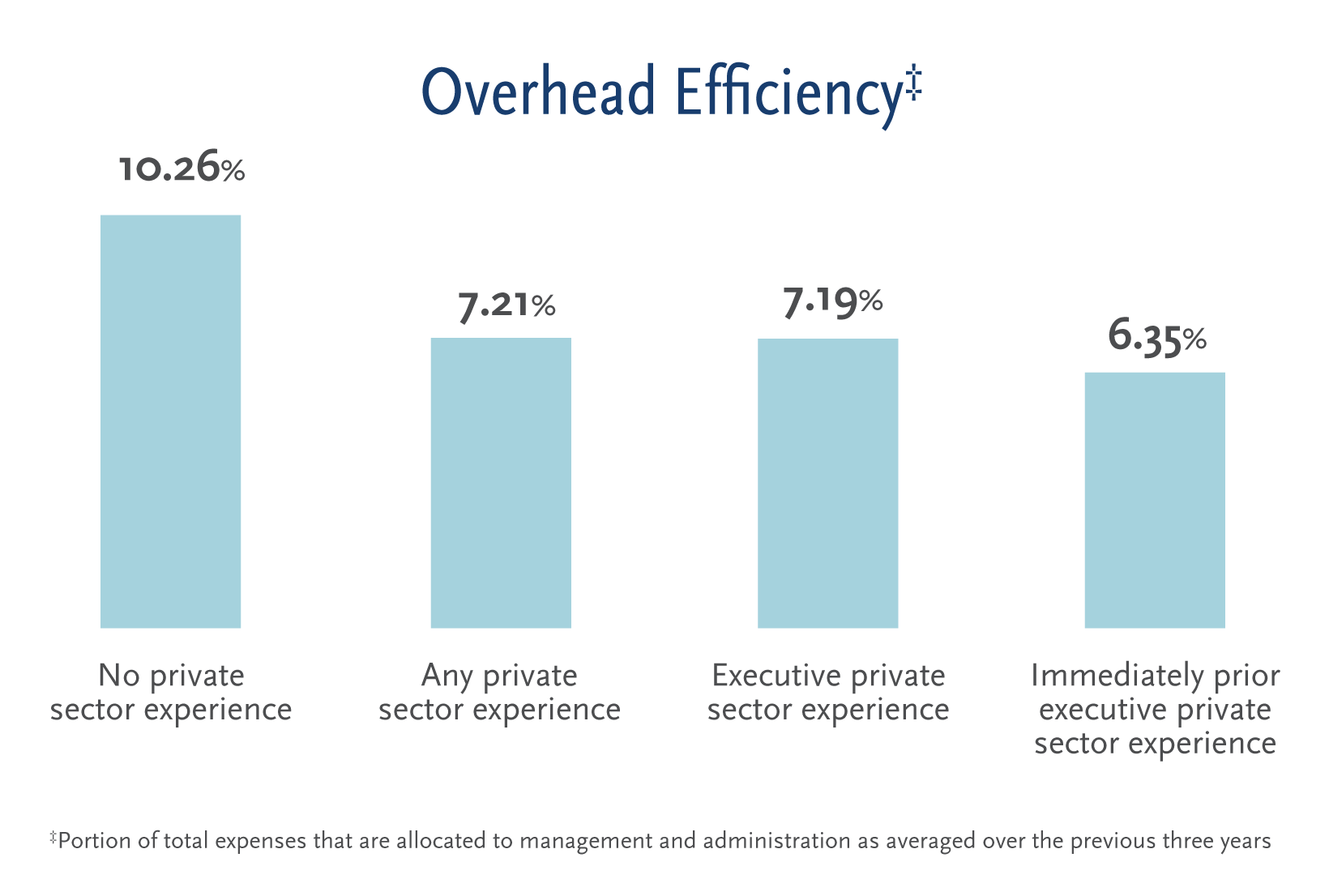

To help answer this question, we analyzed the financial performance of 50 of the largest and most representative international NGOs based in the U.S. against four financial metrics:

- Revenue change

- Program expense change

- Working capital ratio (Ratio of unrestricted and temporarily restricted assets to total expenses in given year averaged over the previous three years)

- Overhead efficiency (Portion of total expenses that are allocated to management and administration as averaged over the previous three years)

Source: Form 990s from 50 global NGOs with some of the highest revenues in 2015.

What we learned: CEOs with private sector experience lead organizations with greater financial sustainability and with more efficient operations.

While a CEO’s prior executive experience had a significant effect on all of the financial metrics we measured, there was a dramatic decrease in program expense when the CEO came directly from the private sector. Why? One potential explanation is that private sector leaders typically view business opportunities through a global lens and have the operating experience to turn strategy into results. They have a demonstrated ability to manage large teams and to allocate resources discerning mission-critical priorities. Furthermore, they are tested in having to be decisive, rightly considering the politics of cultures around the world and with diverse constituencies — extremely relevant skills in taking a resource-constrained nonprofit to scale.

It also became clear in our research that different combinations of private sector backgrounds across executive functions — including CEOs, COOs, CFOs, and heads of strategy and resource development — work particularly well to impact these metrics. For example, organizations with CEOs and CFOs with previous private sector experiences were found to have a significantly higher working capital ratio than organizations with different kinds of profiles in those roles. Our findings also suggest that the composition of the entire C-suite should be evaluated in organizations where financial efficiency is of increasing importance.

It is important to note that there is no one-size-fits-all approach to NGO leadership. We are often brought in to advise organizations as they undergo significant periods of transition, and our primary objective is to find leaders who will have a long-term positive impact. Private sector experience alone is not enough to ensure success — fit with the organization’s culture and alignment with its strategic direction are critical. For example, there are many organizations that represent their sectors and act as stewards of their work in largely the same way for perpetuity, so the emphasis in those situations is on finding a leader who can maintain the current level of performance established by the founder or long-standing chief executive.

However, organizations that want to transform their business models often need a different type of leader to execute against a new strategy. For these NGOs, one proven way to promote the efficiency needed at a time of disruption is to bring on a CEO and/or other leaders with backgrounds in the private sector.

In an increasingly interconnected world, lines are blurring between the public and private sectors and there is growing recognition that financial impact and social impact are intertwined. More and more forward-thinking private sector organizations looking to expand into emerging markets are partnering with social enterprises operating in those regions, recognizing the role they play in creating healthy local economies. At the same time, in order to succeed in a challenging fundraising environment, NGOs will need to place a greater emphasis on financial efficiency like their private sector brethren. Simply put, without financial health, social enterprises cannot make an enduring impact. A CEO with a private sector background can have a tangible impact on the financial health of a nonprofit, and, as a result, a far-reaching impact on the community it serves.

Anne Simonds leads Spencer Stuart’s efforts at the intersection of global development and social enterprises, aligning the firm’s corporate, nonprofit and public sector networks. A member of the Education, Nonprofit & Government, Healthcare Services and Healthcare practices, she specializes in CEO and president searches and board and leadership advisory engagements for organizations worldwide. Reach her via email and follow her on LinkedIn.